Madison’s Reporter: Most Lumber Prices Flat as Benchmark Items Rise

The North American construction framing dimension softwood lumber market has found even footing at this mid-summer 2022. Prices on almost all lumber and panel items remained flat, with some benchmark commodities rising slightly. A big change coming to how lumber futures are traded on the Chicago Mercantile Exchange has many players excited; details of those changes below. The recent increase to timber stumpage prices in British Columbia has put some operators in a not-profitable position — in the context of current lumber prices — so several facilities in that province are taking additional or extended downtime and curtailments.

Check back with the Madison’s website www.madisonsreport.com often for the latest softwood lumber prices and market updates.

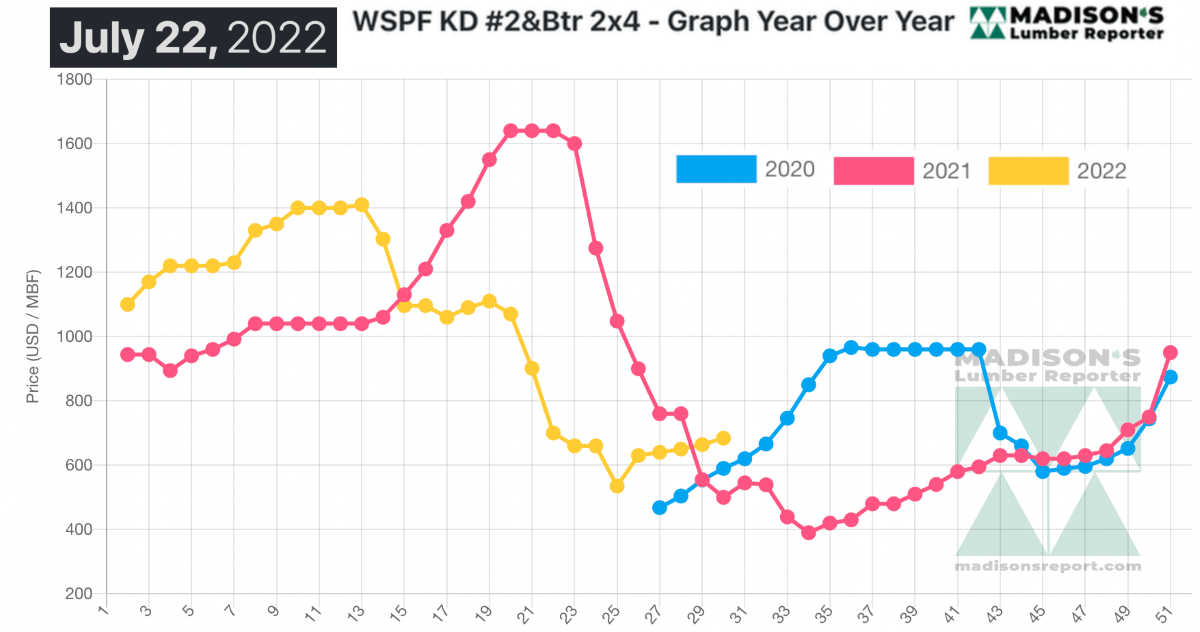

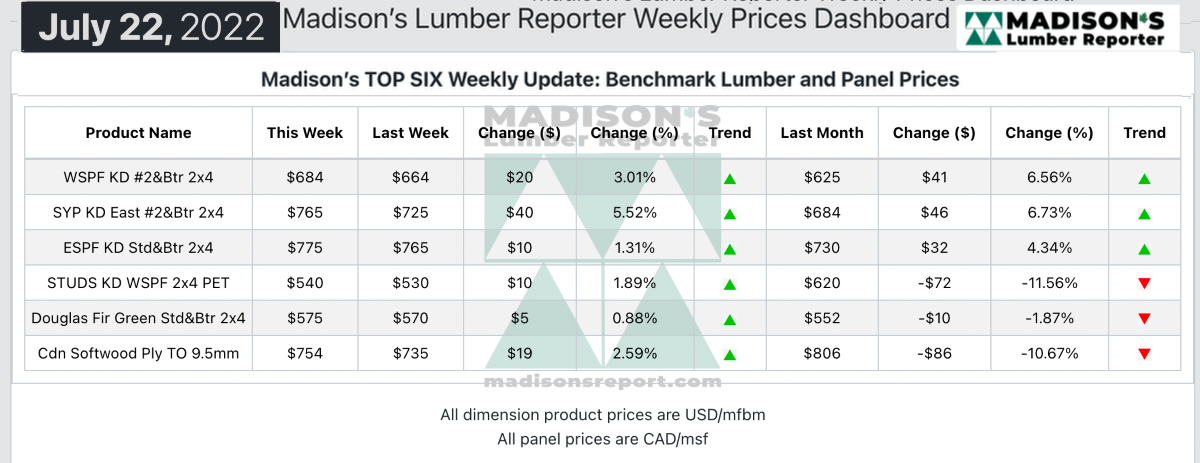

Bumping further upward slightly, for the week ending July 22, 2022 the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$684 mfbm, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter. This is up by +$20, or +3% from the previous week when it was $664, and is up by +$59, or +25%, from one month ago when it was $625.

Field inventories were markedly lean, while mills and wholesalers in Canada showed more availability on several items.

“Demand appeared to pause palpably in most commodity groups as prices generally remained flat.” — Madison’s Lumber Reporter www.madisonsreport.com

Demand for Western S-P-F in the US took a recess according to traders south of the border. Sawmills were in a solid position however, having established strong mid-August order files while keeping their asking prices on firm footing. Lack of transportation equipment continued to be a hurdle, in the way of consistent and timely delivery.

As demand settled down to a more consistent, low-key, pace, suppliers of Western S-P-F lumber in Canada described an even tone to the market. There was a cautious overall feel to trading, with sawmills trying to push sales further to avoid stalling out while buyers tried to convert this latest breather into a price correction by holding off ordering. Two- to three-week order files were widely reportedly sawmills.

“Purveyors of Western S-P-F studs entertained stout demand again, even as overall activity from buyers took a step back. Stud mills were busy enough to keep prices firm from the previous week or even to boost numbers a few points. Caution among buyers was evident however, as many leaned harder on mixed loads and LTL orders from the distribution network. Order files were between two- and three-weeks out.” — Madison’s Lumber Reporter www.madisonsreport.com

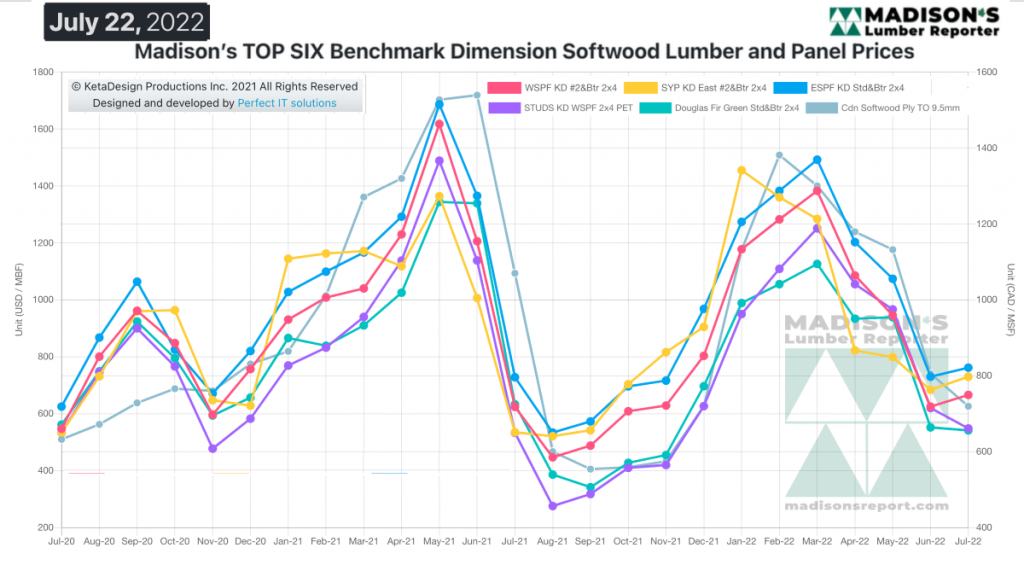

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages

Compared to the same week last year, when it was US$500 mfbm, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending July 22, 2022 was up by +$184, or +37%. Compared to two years ago when it was $590, that week’s price is up by +$94, or +16%.

About Madison’s Lumber Reporter

Established in 1952, Madison’s Lumber Prices is your premiere source for North American softwood lumber news, prices, industry insight, and industry contacts. The weekly Madison’s Lumber Reporter publishes current Canadian and US construction framing dimension lumber and panel wholesaler pricing information 50 weeks a year and access to historical pricing as well.

Contact:

Keta Kosman – Publisher, Madison’s Lumber Reporter – (604) 319-2266 – www.madisonsreport.com

Source: Madison’s Lumber Reporter