Mortgage Applications Decrease in March 20th MBA Weekly Survey

Mortgage applications decreased 29.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (“MBA”) Weekly Mortgage Applications Survey for the week ending March 20, 2020.

The Market Composite Index, a measure of mortgage loan application volume, decreased 29.4 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 29 percent compared with the previous week. The Refinance Index decreased 34 percent from the previous week and was 195 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 15 percent from one week earlier. The unadjusted Purchase Index decreased 14 percent compared with the previous week and was 11 percent lower than the same week one year ago.

“The 30-year fixed mortgage rate reached its highest level since mid-January last week, even as Treasury yields remained at relatively low levels. Several factors pushed rates higher, including increased secondary market volatility, lenders grappling with capacity issues and backlogs in their pipelines, and remote work staffing challenges,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “With these higher rates, refinance activity fell 34 percent, and both the conventional and government indices dropped to their lowest level in a month. Looking ahead, this week’s additional actions taken by the Federal Reserve to restore liquidity and stabilize the mortgage-backed securities market could put downward pressure on mortgage rates, allowing more homeowners the opportunity to refinance.”

Added Kan, “Home purchase applications were notably impacted by rising rates and the widespread economic disruption and uncertainty over household employment and incomes. Last week’s purchase index fell 15 percent to its lowest level since August 2019. Compared to a year ago, purchase applications were down 11 percent – the first year-over-year decline in over three months. Potential homebuyers might continue to hold off on buying until there is a slowdown in the spread of the coronavirus and more clarity on the economic outlook.”

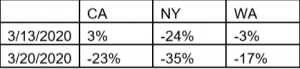

As an early look into the coronavirus-related impact at the state level, below are results showing the not seasonally adjusted, weekly percent change in the number of purchase applications from California, New York, and Washington:

The refinance share of mortgage activity decreased to 69.3 percent of total applications from 74.5 percent the previous week. The adjustable-rate mortgage (“ARM”) share of activity decreased to 6.1 percent of total applications.

The FHA share of total applications increased to 8.4 percent from 7.3 percent the week prior. The VA share of total applications decreased to 12.5 percent from 14.5 percent the week prior. The USDA share of total applications remained unchanged from 0.4 percent the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased to 3.82 percent from 3.74 percent, with points decreasing to 0.35 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (“LTV”) loans. The effective rate increased from last week.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $510,400) increased to 3.84 percent from 3.77 percent, with points increasing to 0.35 from 0.32 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA decreased to 3.69 percent from 3.71 percent, with points increasing to 0.43 from 0.28 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 15-year fixed-rate mortgages increased to 3.28 percent from 3.10 percent, with points increasing to 0.38 from 0.37 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 5/1 ARMs increased to 3.38 percent from 3.19 percent, with points increasing to 0.26 from 0.19 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The survey covers over 75 percent of all U.S. retail residential mortgage applications, and has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks and thrifts. Base period and value for all indexes is March 16, 1990=100.

Contact:

Adam DeSanctis – adesanctis@mba.org – (202) 557-2727

Source: Mortgage Bankers Association