Freddie Mac: Mortgage Rates Near All-Time Lows in April 16th Report

Freddie Mac released the results of its Primary Mortgage Market Survey® (“PMMS”®), showing that the 30-year fixed-rate mortgage (“FRM”) averaged 3.31 percent.

“Mortgage rates continue to hover near all-time lows for the third straight week. As a result, refinance activity remains high, but home purchase demand is weak due to economic tightening,” said Sam Khater, Freddie Mac’s Chief Economist.

Khater continued, “While new monthly economic data are driving markets lower this week, they are a lagging indicator and should be priced in already. Real time daily economic activity metrics suggest that the economy will likely not decline much further. Going forward, the key question is no longer the depth of the economic contraction, but the duration.”

News Facts

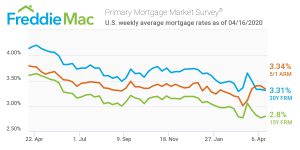

– 30-year fixed-rate mortgage averaged 3.31 percent with an average 0.7 point for the week ending April 16, 2020, down from last week when it averaged 3.33 percent. A year ago at this time, the 30-year FRM averaged 4.17 percent.

– 15-year fixed-rate mortgage averaged 2.80 percent with an average 0.7 point, up from last week when it averaged 2.77 percent. A year ago at this time, the 15-year FRM averaged 3.62 percent.

– 5-year Treasury-indexed hybrid adjustable-rate mortgage (“ARM”) averaged 3.34 percent with an average 0.3 point, down from last week when it averaged 3.40 percent. A year ago at this time, the 5-year ARM averaged 3.78 percent.

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following link for the Definitions. Borrowers may still pay closing costs which are not included in the survey.

Freddie Mac makes home possible for millions of families and individuals by providing mortgage capital to lenders. Since our creation by Congress in 1970, we’ve made housing more accessible and affordable for homebuyers and renters in communities nationwide. We are building a better housing finance system for homebuyers, renters, lenders, investors and taxpayers. Learn more at FreddieMac.com, Twitter @FreddieMac and Freddie Mac’s blog FreddieMac.com/blog.

Contact:

Angela Waugaman – Angela_Waugaman@FreddieMac.com – (703) 714-4829

Source: Freddie Mac