Freddie Mac: Mortgage Rates Show Little Movement in August 19th Report

Freddie Mac released the results of its Primary Mortgage Market Survey® (“PMMS”®), showing that the 30-year fixed-rate mortgage (“FRM”) averaged 2.86 percent.

“Mortgage rates stayed relatively flat this week,” said Sam Khater, Freddie Mac’s Chief Economist. “Housing is in a similar phase of the economic cycle as many other consumer goods. While there is strong latent demand, low supply has caused prices to rise as shortages restrict the amount of sales activity that otherwise would occur.”

News Facts

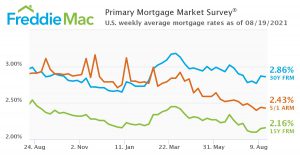

– 30-year fixed-rate mortgage averaged 2.86 percent with an average 0.7 point for the week ending August 19, 2021, down slightly from last week when it averaged 2.87 percent. A year ago at this time, the 30-year FRM averaged 2.99 percent.

– 15-year fixed-rate mortgage averaged 2.16 percent with an average 0.6 point, up slightly last week when it averaged 2.15 percent. A year ago at this time, the 15-year FRM averaged 2.54 percent.

– 5-year Treasury-indexed hybrid adjustable-rate mortgage (“ARM”) averaged 2.43 percent with an average 0.3 point, down slightly from last week when it averaged 2.44 percent. A year ago at this time, the 5-year ARM averaged 2.91 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit. Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following link for the Definitions. Borrowers may still pay closing costs which are not included in the survey.

Freddie Mac makes home possible for millions of families and individuals by providing mortgage capital to lenders. Since our creation by Congress in 1970, we’ve made housing more accessible and affordable for homebuyers and renters in communities nationwide. We are building a better housing finance system for homebuyers, renters, lenders, investors and taxpayers. Learn more at FreddieMac.com, Twitter @FreddieMac and Freddie Mac’s blog FreddieMac.com/blog.

Contact:

Chad Wandler – Media Contact – Chad_Wandler@FreddieMac.com – (703) 946-0004

Source: Freddie Mac