NAR: Two-Thirds of Metros Reached Double-Digit Price Appreciation in Fourth Quarter of 2021

The fourth quarter of 2021, much like the third quarter, saw home prices continue to increase, although at a slower pace. Fewer markets in the last quarter experienced double-digit price gains.

Key Highlights

- In the fourth quarter of 2021, fewer markets – 67% of 183 metro areas – had a double-digit increase in the median single-family existing-home sales price (78% in the prior quarter).

- The median sales price of single-family existing homes rose at a slower pace of 14.6% to $361,700 (15.9% in the prior quarter).

- With sustained price appreciation and higher mortgage rates, affordability worsened in the fourth quarter as the monthly mortgage payment on a typical existing single-family home with 20% down payment rose by $201 from a year ago to $1,240, or 16.9% of the median family income.

According to the latest quarterly report from the National Association of Realtors®, out of 183 measured markets, 67% of the metros reached double-digit price appreciation compared to 78% in the prior quarter. Nationally, the median single-family existing-home price rose at a slower rate of 14.6% year-over-year to $361,700 compared to the year-over-year pace in the previous quarter (15.9%). While the third quarter of 2021 witnessed all regions achieve double-digit price gains, the fourth quarter saw only the South experience double-digit price appreciation (17.9%), and single-digit price gains in the Northeast (6.8%), Midwest (8.6%), and the West (7.7%).1

“Homebuyers in the last quarter saw little relief as home prices continued to climb, albeit not as fast as earlier in the year,” said Lawrence Yun, NAR chief economist. “The increasing prices are indicative of a seller’s market, with an abundance of eager buyers and very limited supply.”

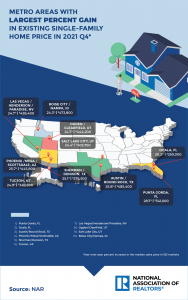

Metros in the Sunbelt and Mountain states topped the list of areas with the highest yearly price gains: Punta Gorda, Fla. (28.7%); Ocala, Fla. (28.2%); Austin-Round Rock, Texas (25.8%); Phoenix-Mesa-Scottsdale, Ariz. (25.7%); Sherman-Denison, Texas (25.1%); Tucson, Ariz. (24.9%); Las Vegas-Henderson-Paradise, Nev. (24.7%); Ogden-Clearfield, Utah (24.7%); Salt Lake City, Utah (24.4%); and Boise City-Nampa, Idaho (24.3%).

The top 10 most expensive markets in the fourth quarter witnessed prices surge, with nine of them doing so by double-digit percentages. California led the way with five metros in the top 10, along with five other areas, including: San Jose-Sunnyvale-Sta. Clara, Calif. ($1,675,000; 19.6%); San Francisco-Oakland-Hayward, Calif. ($1,310,000; 14.9%); Anaheim-Santa Ana-Irvine, Calif. ($1,150,000; 23%); Urban Honolulu, Hawaii ($1,054,500; 16.8%); San Diego-Carlsbad, Calif. ($845,000; 14.2%); Los Angeles-Long Beach-Glendale, Calif. ($797,900; 15.9%); Boulder, Colo. ($775,100; 17.2%); Seattle-Tacoma-Bellevue, Wash. ($700,000; 13.9%); Naples-Immokalee-Marco Island, Fla. ($685,000; 21.2%); and Nassau County-Suffolk County, N.Y. (644,600; 9%).

“The strength of price gains are associated with the strength of the local job market, but the escalating prices took a toll on home shoppers, compelling many to come up with extra cash, and forcing others to delay making a purchase altogether,” said Yun. “A number of families, especially would-be first-time buyers, are increasingly being forced out of the market, and this is why supply is critical to expanding homeownership opportunity.”

While mounting housing costs were problematic for the entire year, affordability worsened in the fourth quarter compared to one year ago. Making the marketplace even more of a challenge was the certainty of increasing mortgage rates.

In the fourth quarter, the average monthly mortgage payment on an existing single-family home –valued at $361,700 and financed with a 20% down payment, 30-year loan at a mortgage rate of 3.13% – rose to $1,240. This was an increase of $201 from one year ago (median price of $315,700; mortgage rate of 2.81%). Families typically spent 16.9% of their income on mortgage payments, while one year ago families spent 14.7%.

During this same period, a home purchase was unaffordable for a typical first-time buyer who was intending to purchase a home. The typical mortgage payment on a 10% down payment loan on a typical starter home valued at $307,400 increased to $1,224, a rise of $198 from one year ago (starter home price of $268,300; mortgage rate of 2.81%). First-time buyers generally spent 25.6% of their household income on mortgage payments, making a home purchase unaffordable. A mortgage is considered affordable if its payment (principal and interest) amounts to 25% or less of a family’s income.2

“The good news is that home prices should begin to normalize later in 2022 as more homes come on the market,” said Yun.

In 20 markets where the median home sales price ranged from $537,400 to $1.675 million, a family needed more than $100,000 to afford a 10% down payment mortgage (17 markets in the previous quarter). These metros were found in California (San Jose-Sunnyvale-Santa Clara, San Francisco-Oakland-Hayward, Anaheim-Santa Ana-Irvine, San Diego-Carlsbad, Los Angeles-Long Beach-Glendale), Hawaii (Urban Honolulu), Colorado (Boulder, Denver-Aurora-Lakewood, Fort Collins), Washington and Oregon (Seattle-Tacoma-Bellevue, Portland-Vancouver-Hillsboro), Florida (Naples-Immokalee-Marco Island), Massachusetts and New Hampshire (Barnstable Town, Boston-Cambridge-Newton), New York, New Jersey, and Pennsylvania (Nassau County-Suffolk County, New York-Newark-Jersey City, New York-Jersey City-White Plains), Connecticut (Bridgeport-Stamford-Norwalk), Nevada (Reno), and the Washington, D.C.-Arlington-Alexandria metro area.3

Conversely, in 81 other markets – where the median sales price was at least $267,700 or less – a family needed less than $50,000 to afford a home (83 markets in the prior quarter). In 12 metro areas where the median home sales price was less than $160,000, a family generally needed less than $30,000 to purchase a home. Those areas were in Illinois and Iowa (Decatur, Peoria, Davenport-Moline-Rock Island, Waterloo-Cedar Falls, Springfield, Rockford), Ohio and Pennsylvania (Youngstown-Warren-Boardman, Toledo, Erie), New York (Binghamton, Elmira), and Maryland and West Virginia (Cumberland).

The National Association of Realtors® is America’s largest trade association, representing more than 1.5 million members involved in all aspects of the residential and commercial real estate industries.

# # #

Data tables for MSA home prices (single-family and condo) are posted at https://www.nar.realtor/research-and-statistics/housing-statistics/metro…. If insufficient data is reported for an MSA in a particular quarter, it is listed as N/A. For areas not covered in the tables, please contact the local association of Realtors®.

NOTE: NAR releases quarterly median single-family price data for approximately 183 Metropolitan Statistical Areas (MSAs). In some cases, the MSA prices may not coincide with data released by state and local Realtor® associations. Any discrepancy may be due to differences in geographic coverage, product mix, and timing. In the event of discrepancies, Realtors® are advised that for business purposes, local data from their association may be more relevant.

1 Areas are generally metropolitan statistical areas as defined by the U.S. Office of Management and Budget. NAR adheres to the OMB definitions, although in some areas an exact match is not possible from the available data. A list of counties included in MSA definitions is available at: https://www.census.gov/geographies/reference-files/time-series/demo/metr…(link is external). Regional median home prices are from a separate sampling that includes rural areas and portions of some smaller metros that are not included in this report; the regional percentage changes do not necessarily parallel changes in the larger metro areas. The only valid comparisons for median prices are with the same period a year earlier due to seasonality in buying patterns. Quarter-to-quarter comparisons do not compensate for seasonal changes, especially for the timing of family buying patterns. Median price measurement reflects the types of homes that are selling during the quarter and can be skewed at times by changes in the sales mix. For example, changes in the level of distressed sales, which are heavily discounted, can vary notably in given markets and may affect percentage comparisons. Annual price measures generally smooth out any quarterly swings. NAR began tracking of metropolitan area median single-family home prices in 1979; the metro area condo price series dates back to 1989. Because there is a concentration of condos in high-cost metro areas, the national median condo price often is higher than the median single-family price. In a given market area, condos typically cost less than single-family homes. As the reporting sample expands in the future, additional areas will be included in the condo price report. The seasonally adjusted annual rate for a particular quarter represents what the total number of actual sales for a year would be if the relative sales pace for that quarter was maintained for four consecutive quarters. Total home sales include single-family, townhomes, condominiums and co-operative housing.

2 Housing costs are burdensome if they take up more than 30% of income. The 25% share of mortgage payment to income considers the idea that homeowners have additional expenses, including mortgage insurance, home insurance, taxes, and expenses for property maintenance.

3 The title of each metropolitan or micropolitan statistical area consists of the names of up to three of its principal cities and the name of each state into which the metropolitan or micropolitan statistical area extends.

Source: National Association of Realtors