NAHB: Inflation Hits Another New 40-Year High in March

Driven by higher food, gasoline and housing cost, consumer prices continued to accelerate in March. This marked the sixth straight month for inflation above a 6% rate and was the fastest annual pace since December 1981. Though gas prices have fallen slightly from their March highs, the pace of inflation will likely stay high in the months ahead as lockdowns in China threaten more global supply chain disruption.

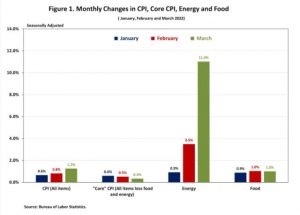

The Bureau of Labor Statistics (“BLS”) reported that the Consumer Price Index (“CPI”) rose by 1.2% in March on a seasonally adjusted basis, following an increase of 0.8% in February. Excluding the volatile food and energy components, the “core” CPI increased by 0.3% in March, following an increase of 0.5% in February. The price index for a broad set of energy sources rose by 11.0% in March, and the food index increased by 1.0%.

In March, the indexes for gasoline, shelter, and food were the largest contributors to the increase in the headline CPI. The gasoline index rose by 18.3% in March and accounted for over half of the headline CPI increase. Meanwhile, the food index rose by 1.0% as the food at home index rose 1.5 percent.

The index for shelter, which makes up more than 40% of the “core” CPI, rose by 0.5% in March. The indexes for owners’ equivalent rent (“OER”) and rent of primary residence (“RPR”) both increased by 0.4% over the month. Monthly increases in OER have averaged 0.4% over the last three months. More cost increases are coming from this category, which will add to inflationary forces in the months ahead.

During the past twelve months, on a not seasonally adjusted basis, the CPI rose by 8.5% in March, following a 7.9% increase in February. The “core” CPI increased by 6.5% over the past twelve months, following a 6.4% increase in February. It was the largest annual growth since August 1982. The food index rose by 8.8%, the largest annual increase since May 1981, and the energy index climbed by 32.0% over the past twelve months.

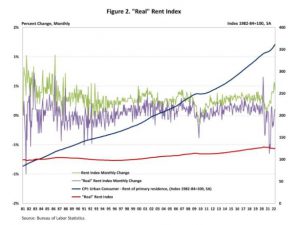

NAHB constructs a “real” rent index to indicate whether inflation in rents is faster or slower than overall inflation. It provides insight into the supply and demand conditions for rental housing. When inflation in rents is rising faster (slower) than overall inflation, the real rent index rises (declines). The real rent index is calculated by dividing the price index for rent by the core CPI (to exclude the volatile food and energy components).

The Real Rent Index rose by 0.1% in March, after increasing by 0.1% in February. Over the first three months of 2022, the monthly change of the Real Rent Index remained virtually unchanged, on average.

Source: National Association of Home Builders