Madison’s Reporter: Some Lumber Prices Increase as Inventory Woes Ease

It was this same week last year when lumber prices reached an unimaginable all-time high, and stayed that way for a few short weeks before falling consistently through summer to almost meet the lows of 2019. As mentioned last week, this year prices are topping-out lower, and are bottoming-out higher. As industry and customers are realizing the “new normal” price levels in this post-Covid19 world, it seems that the incredible volatility of the past two years is behind us. In the past, this would be the time of year that lumber prices start to soften, as the major home builders and retailers would have made their largest-volume purchases for the coming building season. Whether that previously “normal” seasonality will come into play this year remains to be seen. Regardless, it is generally acknowledged that those extreme highs of last year will probably not return, and customers can expect more regular price swings going forward.

Check back with the Madison’s website www.madisonsreport.com often for the latest softwood lumber prices and market updates.

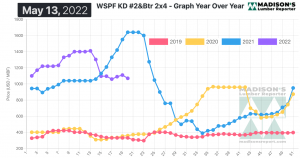

Dropping somewhat after weeks of staying flat, for the week ending May 13, 2022 the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$1,070 mfbm, down -$40, or -4%, from the previous week when it was $1,110, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter. That week’s price is down by -$16, or -1% from one month ago when it was $1,086.

Field inventories were thin across the board even as construction markets revved up to finish jobs before interest rates rise in the coming months.

“North American lumber prices flattened out as a pensive tone permeated business in most respects.” – Madison’s Lumber Reporter

A weakening Futures board sent many US buyers of Western S-P-F lumber and studs to the sidelines. Those who were active found sawmill lists wanting. There were significant delays on highly sought-after widths and stud trims thanks to an ongoing lack of transportation equipment. Secondary suppliers continued to offer quicker shipment but at less flexible price points. Shipping backlogs put sawmill order files into the week of May 30th, indeed pushing into June.

Reported price levels of Western S-P-F dimension commodities were largely flat according to Canadian suppliers. Buyers were intermittently active, yet frustrated with the lack of sawmill offerings. That dearth of availability mostly came from an inability to ship, not from production constraints. One veteran player noted that some BC sawmills were buying their Futures position back because they couldn’t find rail cars. On top of ongoing equipment and personnel shortages, fuel surcharges continued their inexorable rise, with British Columbia one of the hardest hit regions in that regard.

“It was a challenging week for suppliers and buyers alike of Eastern S-P-F lumber. Production and shipping costs continued to climb as protracted transportation delays disrupted efficiency up and down the supply chain. Discouraging economic news dominated discourse. Retailers and other buyers got even more cautious, only putting in new orders when absolutely necessary and spending much of their time chasing down wood they had already purchased.” – Madison’s Lumber Reporter

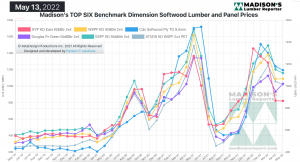

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages

When compared to the same week last year, when it was a mind-boggling US$1,640 mfbm, for the week ending May 13, 2022 price of Western Spruce-Pine-Fir 2×4 was down by -$570, or -35%. Compared to two years’ ago when it was $360, that week’s price is up by +$710, or +197%.

About Madison’s Lumber Reporter

Established in 1952, Madison’s Lumber Prices is your premiere source for North American softwood lumber news, prices, industry insight, and industry contacts. The weekly Madison’s Lumber Reporter publishes current Canadian and US construction framing dimension lumber and panel wholesaler pricing information 50 weeks a year and access to historical pricing as well.

Contact:

Keta Kosman – Publisher, Madison’s Lumber Reporter – (604) 319-2266 –www.madisonsreport.com

Source: Madison’s Lumber Reporter