Barchart: Lumber Back In Falling Knife Mode

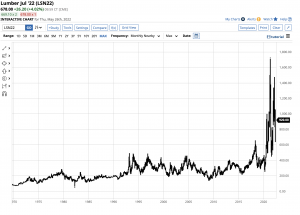

Lumber futures for delivery in July 2022 reached a high of $1,204.70 on March 4, 2022. The continuous contract rallied to $1,477.40 in early March, making a lower high than the May 2021 record $1711.20 per 1,000 board feet peak.

Since early March, lumber has been correcting, falling below the $640 level for the first time in 2022 on May 24. Lumber futures have nearly halved in value since the early March high, which is nothing new for the volatile commodity. In 2021, the price declined to less than one-third of the level at the $1711.20 high when it fell to the $448 per 1,000 board feet in August. Lumber is searching for a bottom as several factors weigh on wood’s price.

Catching a falling knife is dangerous

Lumber has been explosive and implosive in 2021 and 2022 and standing in front of a rally or decline looking for tops or bottoms is very dangerous.

Since early March, the latest trend has been implosive as the July futures contract ran out of upside steam at $1204.70 per 1,000 board feet.

The chart highlights the steady decline that has taken the wood price to its latest low of $636.30 on the July futures contract on May 24. Buyers since early March have been run over by a bearish wooden freight train.

Rising interest rates cool the demand for wood

The latest consumer and producer price index data justify the Fed’s tight monetary policy stance. After increasing the Fed Funds Rate by 50 basis points at the most recent meeting, another 50-basis point hike or more is on the horizon for the June meeting. The central bank has lots of catching up to do with inflation readings at the highest level in over four decades.

Rising interest rates mean that home buyers without the cash will need to pay far higher mortgage rates to finance their purchases. At the end of 2021, a 30-Year conventional fixed-rate mortgage was below the 3% level, and in late May 2022, the rate was around 5.50%. On each $100,000, the difference is steep at $2,500 per year or over $200 each month. The highest mortgage rates are weighing the demand for new homes requiring lumber. While the demand for homes remains robust, higher rates are bearish for lumber prices.

Inflation continues despite monetary policy tightening

Meanwhile, supply chain bottlenecks and the war in Ukraine continue to support commodity prices. Food and energy prices continue to be at the highest prices in years. On May 26, nearby NYMEX crude oil futures were sitting at the $114 per barrel level. Nearby NYMEX natural gas was over $9 per MMBtu. High energy increases production and transportation costs for all commodities, and lumber is no exception. Russian sanctions and retaliation against “unfriendly” countries distort raw material prices. Russia is a leading energy producer and produces timber.

Higher US interest rates may be weighing on some raw material prices, but the war is a factor that rate hikes cannot fully address. Energy, food, lumber, and other raw material supplies are experiencing supply-side pressures creating shortages.

Demand-side tools for a supply-side issue

The Fed and other central banks have toolboxes to deal with demand-side economic issues. In early 2020, as the global pandemic gripped the economy, the central banks slashed interest rates. They provided the liquidity that encouraged borrowing and spending and inhibited saving to stimulate the economy. They increased the money supply to an unprecedented level, planting inflationary seeds. Government stimulus programs only enhanced the inflation that sprouted in late 2020 and bloomed in 2021 and early 2022, pushing the economic condition to the highest level since the late 1970s and early 1980s.

The monetary policy tightening will impact spending, but the war and supply-side issues present a unique dilemma for the central banks with few, if any, tools to deal with supply-side problems. The Fed, central banks, and worldwide governments blamed rising prices on “transitory” pandemic-inspired issues in 2021. In hindsight, they waited too long as 2022 presented new and dangerous economic threats caused by the first major European war since WW II. Moreover, the geopolitical bifurcation between nuclear powers will exacerbate global economy’s supply-side issues economy over the coming months and years.

Lumber could be close to a low- Look for a higher low than in August 2021

I expect lumber to make a higher low than in August 2021, but that does not mean there is more downside ahead for the wood futures market.

The long-term chart shows that before 2018, the all-time high in the lumber futures market was the 1993 $493.50 peak. Last August, the price fell to $448 per 1,000 board feet and bounced. The August 2021 low should contain the current downdraft given supply-side economic issues.

On the upside, $1,000 is the critical psychological resistance level.

Rising interest rates are not bullish for the lumber market, but the price has declined to less than half the level at the early May high. I expect lumber to run out of downside steam sooner rather than later, and another explosive move could be on the horizon as supply-side dynamics continue to support the wood market in mid-2022.

Source: Barchart.com, Inc.