Madison’s Reporter: Lumber Prices Bounce on Equitable Supply-Demand Balance

The significant price cuts of the previous week were successful in spurring renewed demand for softwood lumber materials. Indeed, so successful that prices bounced almost back up to the levels of the week prior. While sales volumes still were not optimal, looming seasonal curtailments motivated somewhat reluctant customers to pull the trigger and buy. That sales boost was enough to prompt producers to raise their prices. The oncoming dual Canada Day / US Independence Day long weekends normally signals the true slow-down of softwood lumber sales, with the annual price lows approaching. It is not known yet whether this year will see the usual seasonal price cycle; a lot depends on macroeconomic conditions like housing starts, and on weather emergencies like storms, floods, or fires.

Check back with the Madison’s website www.madisonsreport.com often for the latest softwood lumber prices and market updates.

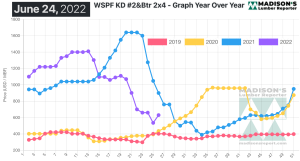

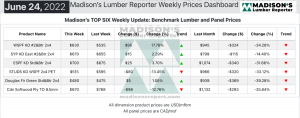

Bouncing hard from a big drop the previous week, for the week ending June 24, 2022 the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was again US$630 mfbm, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter. This is up by +$95, or +18% from the previous week when it was $535 but is down by -$315, or -33%, from one month ago when it was $945.

Buyers were further persuaded to jump in with purchases sooner than later as British Columbia sawmills noted that stumpage fees were slated to increase on July 1st.

“Most dimensional lumber and stud items appeared to put in a price bottom, while panel prices continued to peel off.” — Madison’s Lumber Reporter

Spurred on by a combination of flattening prices, upward movement in lumber futures, and their own bare field inventories, a large contingent of Western S-P-F buyers in the United States got off the fence and dealt. Customers looking to Canadian producers began to scramble a bit as the logistical equation on those orders was complicated by maintenance-related sawmill shutdowns planned for early July.

Canadian Western S-P-F lumber purveyors heaved palpable sighs of relief in unanimously reporting that a price bottom had been reached by midweek. Prices were still indeterminate in many cases, but buyers were certainly more active than they were recently, as they saw numbers evening out. Many decided they couldn’t wait any longer, particularly in view of the typical summer shutdowns scheduled for early July. While there were still deals to be had on much of the prompt material at both regional and national mills, that availability dried up quickly.

“Producers of green Douglas-fir lumber and studs put the brakes on further price corrections as demand ramped up. Many buyers found their preferred price levels and pulled the trigger, especially on 2×4 R/L #2&Btr and nine-foot studs. Prompt shipment still abounded, with some sawmills reporting July 11th order files on stronger items. Transportation was a mill-to-sawmill affair.” — Madison’s Lumber Reporter

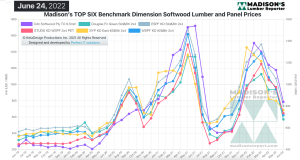

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages

Compared to the same week last year, when it was US$900 mfbm, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending June 24, 2022 was down by -$270, or -30%. Compared to two years’ ago when it was $436, that week’s price is up by +$194, or +44%.

About Madison’s Lumber Reporter

Established in 1952, Madison’s Lumber Prices is your premiere source for North American softwood lumber news, prices, industry insight, and industry contacts. The weekly Madison’s Lumber Reporter publishes current Canadian and US construction framing dimension lumber and panel wholesaler pricing information 50 weeks a year and access to historical pricing as well.

Contact:

Keta Kosman – Publisher, Madison’s Lumber Reporter – (604) 319-2266 –www.madisonsreport.com

Source: Madison’s Lumber Reporter