Weyerhaeuser Reports Third Quarter Results

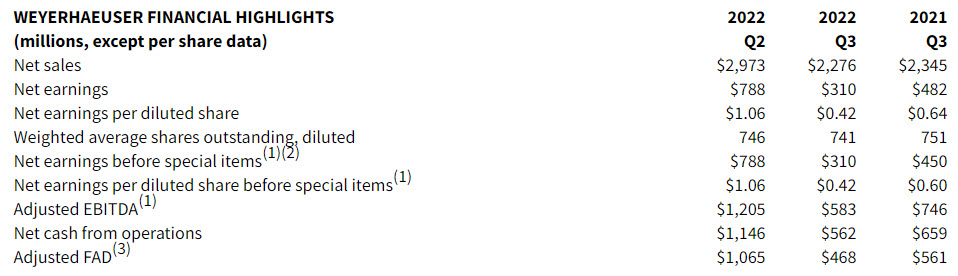

Weyerhaeuser Company (NYSE: WY) today reported third quarter net earnings of $310 million, or 42 cents per diluted share, on net sales of $2.3 billion. This compares with net earnings of $482 million, or 64 cents per diluted share, on net sales of $2.3 billion for the same period last year and net earnings of $788 million for the second quarter of 2022. There were no special items in third quarter or second quarter 2022. Net earnings before special items was $450 million for the same period last year.

Adjusted EBITDA for the third quarter of 2022 was $583 million compared with $746 million for the same period last year and $1.2 billion for the second quarter of 2022.

“In the third quarter, we delivered solid results across our businesses, despite increasing macroeconomic headwinds,” said Devin W. Stockfish, president and chief executive officer. “Although near-term market conditions have moderated, we maintain a constructive longer-term outlook for the demand fundamentals that support our businesses. Looking ahead, our balance sheet is exceptionally strong, and we are well positioned to navigate through a range of market conditions. We remain focused on serving our customers and driving long-term value for our shareholders through an unmatched portfolio of assets, industry-leading performance and disciplined capital allocation.”

| (1) | Net earnings before special items is a non-GAAP measure that management believes provides helpful context in understanding the company’s earnings performance. Additionally, Adjusted EBITDA is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, basis of real estate sold and special items. Net earnings before special items and Adjusted EBITDA should not be considered in isolation from, and are not intended to represent an alternative to, our GAAP results. Reconciliations of net earnings before special items and Adjusted EBITDA to GAAP earnings are included within this release. |

| (2) | Special items for prior periods presented are included in the reconciliation tables within this release. |

| (3) | Adjusted Funds Available for Distribution (Adjusted FAD) is a non-GAAP measure that management uses to evaluate the company’s liquidity. Adjusted FAD, as we define it, is net cash from operations adjusted for capital expenditures and significant non-recurring items. Adjusted FAD measures cash generated during the period (net of capital expenditures and significant non-recurring items) that is available for dividends, repurchases of common shares, debt reduction, acquisitions, and other discretionary and nondiscretionary capital allocation activities. Adjusted FAD should not be considered in isolation from, and is not intended to represent an alternative to, our GAAP results. A reconciliation of Adjusted FAD to net cash from operations is included within this release. |

Timberlands

| FINANCIAL HIGHLIGHTS | 2022 | 2022 | ||||

| (millions) | Q2 | Q3 | Change | |||

| Net sales | $671 | $574 | $(97) | |||

| Net contribution to pretax earnings | $153 | $107 | $(46) | |||

| Adjusted EBITDA | $219 | $168 | $(51) |

Q3 2022 Performance – In the West, fee harvest volumes and domestic sales volumes were lower than the second quarter due to the work stoppage that commenced in mid-September, impacting a portion of our operations in the region. Domestic sales realizations were comparable and per unit log and haul costs were lower. Export sales realizations and volumes were significantly lower due to softening demand, and volumes were further affected by a reduction in export activity resulting from the work stoppage. In the South, fee harvest volumes, sales realizations, and per unit log and haul costs were all comparable to the second quarter. Forestry and road costs in the West and South were seasonally higher.

Q4 2022 Outlook – Weyerhaeuser anticipates fourth quarter earnings and Adjusted EBITDA will be significantly lower than third quarter 2022. In the West, the company expects lower fee harvest and sales volumes resulting from the work stoppage. Sales realizations are expected to be significantly lower due to softening demand. The company expects lower per unit log and haul costs and significantly lower forestry and road costs. In the South, fee harvest volumes and forestry and road costs are expected to be slightly higher, and per unit log and haul costs and sales realizations are expected to be comparable.

Real Estate, Energy & Natural Resources

| FINANCIAL HIGHLIGHTS | 2022 | 2022 | ||||

| (millions) | Q2 | Q3 | Change | |||

| Net sales | $117 | $68 | $(49) | |||

| Net contribution to pretax earnings | $65 | $48 | $(17) | |||

| Adjusted EBITDA | $107 | $60 | $(47) |

Q3 2022 Performance – Earnings and Adjusted EBITDA decreased from the second quarter due to lower real estate sales, partially offset by an increase in royalty income from our Energy and Natural Resources business. The number of real estate acres sold decreased significantly due to the timing of transactions, partially offset by an increase in the average price per acre due to the mix of properties sold.

Q4 2022 Outlook – Weyerhaeuser anticipates fourth quarter earnings and Adjusted EBITDA will be lower than third quarter 2022 due to the timing and mix of real estate sales, as well as lower royalty income from our Energy and Natural Resources business. The company still expects full year 2022 Adjusted EBITDA of approximately $325 million and now expects basis as a percentage of real estate sales to be 35 to 40 percent for the full year.

Wood Products

| FINANCIAL HIGHLIGHTS | 2022 | 2022 | ||||

| (millions) | Q2 | Q3 | Change | |||

| Net sales | $2,341 | $1,767 | $(574) | |||

| Net contribution to pretax earnings | $863 | $344 | $(519) | |||

| Adjusted EBITDA | $912 | $395 | $(517) |

Q3 2022 Performance – Sales realizations for lumber and oriented strand board decreased 28 percent and 41 percent, respectively, compared with second quarter averages. Sales and production volumes for lumber were moderately lower, largely due to the work stoppage at our mills in Washington and Oregon that commenced in mid-September. Unit manufacturing costs were higher, and log costs were moderately lower. Sales and production volumes for oriented strand board were slightly lower due to downtime for planned annual maintenance and transportation challenges in Canada. Unit manufacturing costs were higher, and fiber costs were comparable. Sales realizations were higher for most engineered wood products, while sales and production volumes were lower for most products due to downtime for planned annual maintenance, transportation challenges in Canada and labor constraints. Unit manufacturing costs for engineered wood products were higher, and raw material costs were significantly lower, primarily for oriented strand board webstock.

Q4 2022 Outlook – Weyerhaeuser anticipates fourth quarter earnings and Adjusted EBITDA will be lower than third quarter 2022, excluding the effect of changes in average sales realizations for lumber and oriented strand board. For lumber, the company expects significantly lower log costs, partially offset by lower sales volumes resulting from the work stoppage at our mills in Washington and Oregon. For oriented strand board, the company anticipates slightly higher sales volumes, comparable fiber costs, and significantly lower unit manufacturing costs due to less downtime for planned annual maintenance. Sales volumes and realizations are expected to be lower for most engineered wood products, partially offset by significantly lower raw material costs, primarily for oriented strand board webstock. For distribution, the company expects lower sales volumes and realizations for most products.

For the complete press release, click here.

About Weyerhaeuser

Weyerhaeuser Company, one of the world’s largest private owners of timberlands, began operations in 1900. We own or control approximately 11 million acres of timberlands in the U.S. and manage additional timberlands under long-term licenses in Canada. We manage these timberlands on a sustainable basis in compliance with internationally recognized forestry standards. We are also one of the largest manufacturers of wood products in North America. Our company is a real estate investment trust. In 2021, we generated $10.2 billion in net sales and employed approximately 9,200 people who serve customers worldwide. Our common stock trades on the New York Stock Exchange under the symbol WY. Learn more at www.weyerhaeuser.com.

Contact:

Nancy Thompson – Media Contact – (919) 861-0342

Source: Weyerhaeuser Company