Packaging Corporation of America Reports Fourth Quarter and Full Year 2022 Results

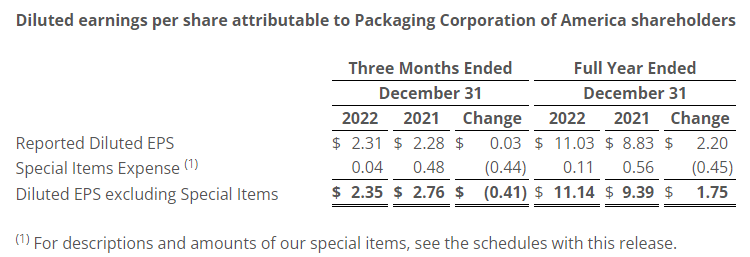

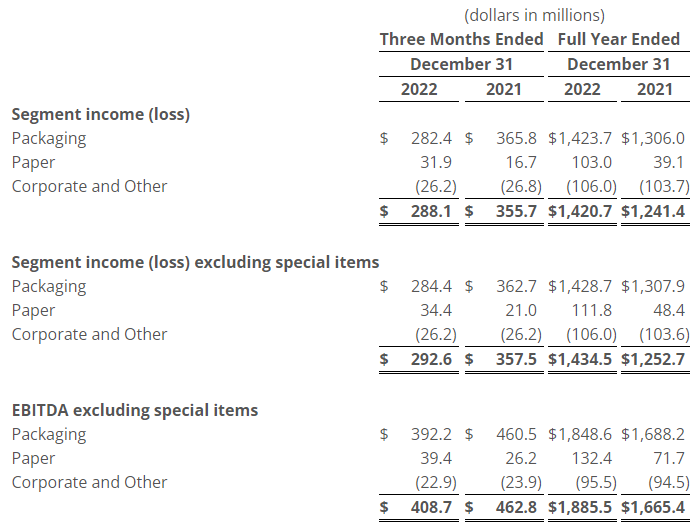

Packaging Corporation of America (NYSE: PKG) today reported fourth quarter 2022 net income of $212 million, or $2.31 per share, and net income of $215 million, or $2.35 per share, excluding special items. Fourth quarter net sales were $1.98 billion in 2022 and $2.04 billion in 2021. Full year 2022 net income was $1.03 billion, or $11.03 per share, and net income of $1.04 billion, or $11.14 per share, excluding special items. Full year net sales were $8.5 billion in 2022 and $7.7 billion in 2021.

Reported earnings in the fourth quarter and full year 2022 include special items primarily for certain costs at the Jackson, AL mill for paper-to-containerboard conversion related activities.

Excluding special items, the $(.41) per share decrease in fourth quarter 2022 earnings compared to the fourth quarter of 2021 was driven primarily by lower volumes in the Packaging ($1.14) and Paper ($.02) segments, higher operating costs ($.48), higher freight and logistics expenses ($.13), higher depreciation expense ($.09), higher converting costs ($.06), and higher scheduled maintenance outage expenses ($.01). These items were partially offset by higher prices and mix in the Packaging $1.18 and Paper $.21 segments, a lower share count resulting from share repurchases $.08, lower interest expense $.04, and a lower tax rate $.01.

Results were $.13 above fourth quarter guidance of $2.22 per share primarily due to higher prices and mix in the Packaging segment, lower freight and logistics expenses, a lower share count resulting from share repurchases, and a lower tax rate.

Financial information by segment is summarized below and in the schedules with this release.

In the Packaging segment, shipments per day were down (8.7%) and total corrugated products shipments, with one less shipping day, were down (10.2%) versus last year’s fourth quarter. Containerboard production was 961,000 tons, and containerboard inventory was down 66,000 tons from the third quarter of 2022 and down 46,000 tons compared to the fourth quarter of 2021. In the Paper segment, sales volume was down 14,000 tons compared to the third quarter of 2022 and down 15,000 tons from the fourth quarter of 2021.

Commenting on reported results, Mark W. Kowlzan, Chairman and CEO, said, “Although demand in our Packaging segment was below our original expectations and we operated our system based on this lower demand, we were able to offset the negative impact through outstanding cost management and process optimization efforts at our mills and corrugated products plants. However, overall, our cost base continued to experience significant inflation compared to last year. Price and mix in our Packaging segment was better than expected, and in our Paper segment we had excellent realization from the price increase we announced in the third quarter. The scheduled annual maintenance outage and the first phase of the conversion project on the No. 3 machine at our Jackson, Alabama mill were executed extremely well. Also, during the quarter we re-purchased over 3 million shares of our stock at an average price of $126.70 per share.”

“Looking ahead as we move from the fourth and into the first quarter,” Mr. Kowlzan continued, “in our Packaging segment we expect box demand on a per day basis to be similar to fourth quarter levels, although we expect higher total volume with corrugated plants having four additional shipping days. Prices will move lower as a result of the recent decreases in the published domestic containerboard prices, and we are assuming lower export prices as well. Paper prices should move slightly higher with sales volume fairly flat. Labor costs and certain indirect costs will increase as some containerboard mill operations were temporarily idled during the fourth quarter. In addition, we anticipate higher labor and benefits costs and other timing-related expenses that occur at the beginning of a new year as well as higher prices for many chemicals, particularly starch and caustic soda. However, we expect lower wood and recycled fiber prices, lower energy prices, and lower scheduled maintenance outage expenses. Lastly, we expect higher interest and non-operating pension expenses and a higher tax rate, but we will see some benefit from our recent share repurchases. Considering these items, we expect first quarter earnings of $2.23 per share.”

We present various non-GAAP financial measures in this press release, including diluted EPS excluding special items, segment income excluding special items and EBITDA excluding special items. We provide information regarding our use of non-GAAP financial measures and reconciliations of historical non-GAAP financial measures presented in this press release to the most comparable measure reported in accordance with GAAP in the schedules to this press release. We present our earnings expectation for the upcoming quarter excluding special items as special items are difficult to predict and quantify and may reflect the effect of future events. We currently anticipate special items in the first quarter of 2023 to include charges, fees, and expenses for paper-to-containerboard conversion related activities at the Jackson, AL mill. We do not currently expect any additional significant special items during the first quarter; however, additional special items may arise due to first quarter events.

PCA is the third largest producer of containerboard products and a leading producer of uncoated freesheet paper in North America. PCA operates eight mills and 89 corrugated products plants and related facilities.

Some of the statements in this press release are forward-looking statements. Forward-looking statements include statements about our future earnings and financial condition, the impact of the COVID-19 pandemic on our business, expected benefits from acquisitions and restructuring activities, our industry and our business strategy. Statements that contain words such as “will”, “should”, “anticipate”, “believe”, “expect”, “intend”, “estimate”, “hope” or similar expressions, are forward-looking statements. These forward-looking statements are based on the current expectations of PCA. Because forward-looking statements involve inherent risks and uncertainties, the plans, actions and actual results of PCA could differ materially. Among the factors that could cause plans, actions and results to differ materially from PCA’s current expectations include the following: the impact of the COVID-19 pandemic on the health of our employees and on the employees of our suppliers and customers, on our ability to operate our business, and on economic conditions affecting our business and demand for our products; the impact of general economic conditions; conditions in the paper and packaging industries, including competition, product demand and product pricing; fluctuations in wood fiber and recycled fiber costs; fluctuations in purchased energy costs; the possibility of unplanned outages or interruptions at our principal facilities; and legislative or regulatory requirements, particularly concerning environmental matters, as well as those identified under Item 1A. Risk Factors in PCA’s Annual Report on Form 10-K for the year ended December 31, 2021, and in subsequent quarterly reports on Form 10-Q, filed with the Securities and Exchange Commission and available at the SEC’s website at “www.sec.gov.”

For the complete press release, click here.

About Packaging Corporation of America

PCA is the third largest producer of containerboard products and a leading producer of uncoated freesheet paper in North America. PCA operates eight mills and 90 corrugated products plants and related facilities.

Contact:

Barbara Sessions – Investor Relations – (877) 454-2509

Source: Packaging Corporation of America