Ethan Allen Reports Strong Fiscal 2023 Third Quarter Operating Results and Increases Regular Quarterly Cash Dividend by 13%

Ethan Allen Interiors Inc. (“Ethan Allen” or the “Company”) (NYSE: ETD) reported its financial and operating results for the fiscal 2023 third quarter ended March 31, 2023.

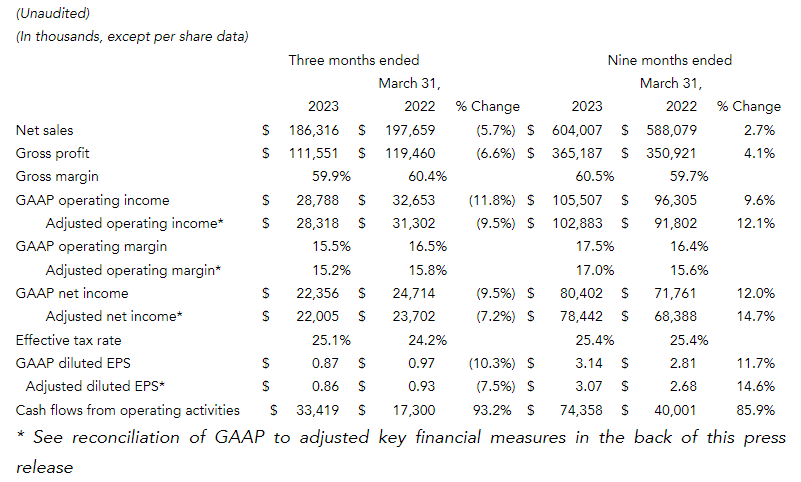

Farooq Kathwari, Ethan Allen’s Chairman, President and CEO commented, “We are pleased with our third quarter operating performance. We delivered consolidated net sales of $186.3 million, gross margin of 59.9%, operating margin of 15.5% and net income of $22.4 million. Our adjusted diluted earnings per share of $0.86 remained strong. We continue to generate strong operating cash flow and as of March 31, 2023, we had total cash and investments of $156.2 million and no debt. Our retail written orders surpassed pre-pandemic levels by 3.6%. We are also pleased to announce that on April 25, 2023, our Board approved an increase to our regular quarterly cash dividend to $0.36 per share, a 13% increase, payable on May 25, 2023.”

Mr. Kathwari continued, “Last week we had a grand reopening of our flagship design center located in Danbury, CT, positioning us as a leading Interior Design Destination. Our product programs continue to be enhanced under the umbrella of Classics with a Modern Perspective. We also continue to strengthen technology options for our interior designers to work with clients. Over the next six months, the projection of most of our 172 design centers in North America will be refreshed to reflect our Danbury, CT design center.”

“We are confident in the investments that we are making for the future, but recognize the need to remain cognizant of the slower economic environment in which we are currently operating in. We remain cautiously optimistic,” concluded Mr. Kathwari.

Fiscal 2023 Third Quarter Highlights*

- Consolidated net sales of $186.3 million decreased 5.7%

- Retail net sales of $150.9 million decreased 9.5%

- Wholesale net sales of $114.2 million decreased 5.7%

- Written order trends

- Retail segment written orders increased 3.6% compared with the pre-pandemic third quarter of fiscal 2019; down 12.3% compared with the third quarter of fiscal 2022

- Wholesale segment written orders decreased 5.9% compared with the third quarter of fiscal 2019; decreased 9.3% from a year ago

- Consolidated gross margin decreased to 59.9%, down from 60.4% a year ago due to a change in sales mix and lower delivered unit volume partially offset by product pricing actions taken over the past 12 months, disciplined promotional activity and lower input costs including reduced inbound freight and raw material costs

- Operating margin of 15.5%; adjusted operating margin of 15.2% compared with 15.8% last year due to lower consolidated net sales, a gross margin reduction and higher retail delivery costs partially offset by our ability to maintain a disciplined approach to cost savings and expense control; selling, general and administrative expenses decreased 5.7% and equaled 44.7% of net sales in both periods presented, as the Company carefully managed expenses in a declining net sales environment

- Advertising expenses were equal to 2.2% of net sales compared to 2.3% in the prior year third quarter; continued to utilize various advertising mediums including digital, direct mail, national television and radio; disciplined promotional activity remained comparable to the prior year

- Diluted EPS of $0.87 compared with $0.97; adjusted diluted EPS of $0.86 decreased 7.5%

- Generated $33.4 million of cash from operating activities, up 93.2% over the prior year

- Paid regular quarterly cash dividends totaling $16.3 million

- Ended the quarter with $156.2 million in cash and investments with no debt outstanding

- Lowered inventory levels to $151.7 million as of March 31, 2023, down $24.8 million from June 30, 2022

* See reconciliation of GAAP to adjusted key financial measures in the back of this press release. Comparisons are to the third quarter of fiscal 2022.

Key Financial Measures*

Balance Sheet and Cash Flow

Cash and investments totaled $156.2 million at March 31, 2023, compared with $121.1 million at June 30, 2022. The increase of $35.1 million during the fiscal year was primarily due to $74.4 million in cash generated from operating activities and $8.1 million in proceeds received from a sale-leaseback transaction completed in August 2022 partially offset by $37.2 million in cash dividends paid and capital expenditures of $10.7 million as the Company continues to return capital to shareholders and reinvest back into the business.

Cash dividends paid were $37.2 million during the nine months ended March 31, 2023, which included a special cash dividend of $12.7 million, or $0.50 per share paid in August 2022.

Cash from operating activities totaled $74.4 million during the first nine months of fiscal 2023, an increase from $40.0 million in the prior year period due to a reduction in inventory carrying levels and accounts receivable combined with higher net income partially offset by a decline in customer deposits.

Inventories, net decreased to $151.7 million at March 31, 2023, compared with $176.5 million at June 30, 2022, as the Company restores its operating inventory levels to more historical norms as backlog declines. Inventory balances continue to decrease as the Company seeks to reduce its levels of inventory while also ensuring appropriate levels are maintained to service its customer base.

Customer deposits from written orders totaled $92.8 million at March 31, 2023, a decrease of $28.3 million during the fiscal year as retail net shipments outpaced written orders.

No debt outstanding at March 31, 2023.

Dividends

On April 25, 2023, the Company’s Board of Directors declared and increased the regular quarterly cash dividend to $0.36 per share, payable on May 25, 2023, to shareholders of record at the close of business on May 9, 2023. Ethan Allen has a long history of returning capital to shareholders and is pleased to increase its regular quarterly cash dividend by 13%, which highlights the Company’s strong balance sheet and operating results. The Company has paid an annual cash dividend every year since 1996 and increased its quarterly cash dividend each of the past five years.

For the complete press release, click here.

About Ethan Allen

Ethan Allen Interiors Inc. (NYSE: ETD) is a leading interior design company, manufacturer and retailer in the home furnishings marketplace. The Company is a global luxury home fashion brand that is vertically integrated from product design through home delivery, which offers its customers stylish product offerings, artisanal quality, and personalized service. The Company provides complimentary interior design service to its clients and sells a full range of home furnishings through a retail network of design centers located throughout the United States and abroad as well as online at ethanallen.com. Ethan Allen owns and operates ten manufacturing facilities located in the United States, Mexico and Honduras, including one sawmill, one rough mill and a lumberyard. Approximately 75% of its products are manufactured or assembled in these North American facilities.

Contact:

Matt McNulty – Senior Vice President, CFO and Treasurer – IR@ethanallen.com

Source: Ethan Allen Interiors Inc.