Weyerhaeuser Reports First Quarter Results

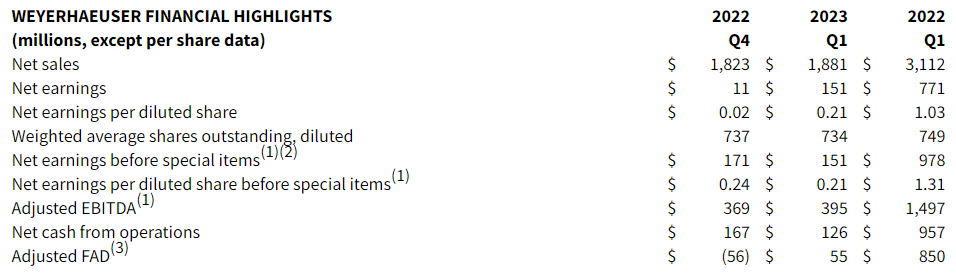

Weyerhaeuser Company (NYSE: WY) today reported first quarter net earnings of $151 million, or 21 cents per diluted share, on net sales of $1.9 billion. This compares with net earnings of $771 million, or $1.03 per diluted share, on net sales of $3.1 billion for the same period last year and net earnings of $11 million for the fourth quarter of 2022. There were no special items in first quarter 2023. Net earnings before special items were $978 million for the same period last year and $171 million for the fourth quarter of 2022. Adjusted EBITDA for the first quarter of 2023 was $395 million compared with $1.5 billion for the same period last year and $369 million for the fourth quarter of 2022.

“I am pleased with the solid operational and financial results delivered by our teams in the first quarter,” said Devin W. Stockfish, president and chief executive officer. “In addition, during the quarter we increased our base dividend by 5.6 percent and returned more than $830 million to shareholders through base and supplemental dividend payments and share repurchase activity. Looking forward, we remain constructive on the longer-term demand fundamentals that will drive growth for our businesses, notwithstanding the current macroeconomic headwinds. Our financial position is exceptionally strong, and we remain focused on driving operational excellence across our unmatched portfolio of assets and enhancing shareholder value through disciplined capital allocation.”

| (1) | Net earnings before special items is a non-GAAP measure that management believes provides helpful context in understanding the company’s earnings performance. Additionally, Adjusted EBITDA is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, basis of real estate sold and special items. Net earnings before special items and Adjusted EBITDA should not be considered in isolation from, and are not intended to represent an alternative to, our GAAP results. Reconciliations of net earnings before special items and Adjusted EBITDA to GAAP earnings are included within this release. |

| (2) | Special items for prior periods presented are included in the reconciliation tables within this release. |

| (3) | Adjusted Funds Available for Distribution (Adjusted FAD) is a non-GAAP measure that management uses to evaluate the company’s liquidity. Adjusted FAD, as we define it, is net cash from operations adjusted for capital expenditures and significant non-recurring items. Adjusted FAD measures cash generated during the period (net of capital expenditures and significant non-recurring items) that is available for dividends, repurchases of common shares, debt reduction, acquisitions, and other discretionary and nondiscretionary capital allocation activities. Adjusted FAD should not be considered in isolation from, and is not intended to represent an alternative to, our GAAP results. A reconciliation of Adjusted FAD to net cash from operations is included within this release. |

Q1 2023 Performance – In the West, fee harvest volumes were significantly higher than the fourth quarter which had one month of operations affected by the work stoppage. Sales volumes were significantly higher, particularly for export volumes to China. Sales realizations were lower, driven by domestic and Japanese export sales. Per unit log and haul costs were moderately lower and forestry and road costs were seasonally lower. In the South, fee harvest volumes were slightly higher and sales realizations were comparable. Per unit log and haul costs were slightly lower and forestry and road costs were slightly higher.

Q2 2023 Outlook – Weyerhaeuser anticipates second quarter earnings and Adjusted EBITDA will be approximately $20 million lower than the first quarter. In the West, the company expects moderately lower sales realizations, partially offset by significantly lower per unit log and haul costs and moderately higher fee harvest volumes. In the South, sales realizations and per unit log and haul costs are expected to be slightly lower, while fee harvest volumes are expected to be comparable. The company expects forestry and road costs in the West and South to be seasonally higher.

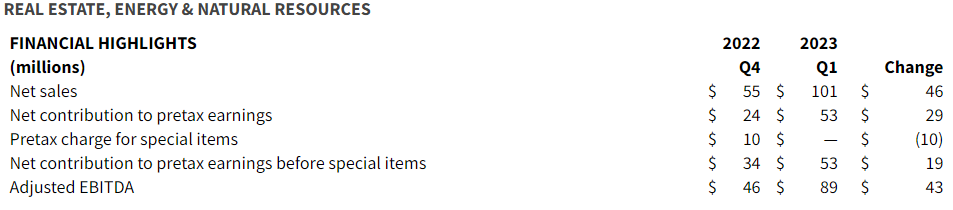

Q1 2023 Performance – Earnings and Adjusted EBITDA increased from the fourth quarter due to higher real estate sales, partially offset by lower royalty income from the company’s Energy and Natural Resources business. The number of acres sold increased significantly due to the timing of transactions, and the average price per acre decreased due to the mix of properties sold.

Q2 2023 Outlook – Weyerhaeuser anticipates second quarter earnings will be comparable to the first quarter and Adjusted EBITDA will be approximately $20 million lower than the first quarter due to the timing and mix of real estate sales.

Q1 2023 Performance – Sales realizations for lumber and oriented strand board decreased 9 percent and 20 percent, respectively, compared with fourth quarter averages. Sales and production volumes for lumber were significantly higher than the fourth quarter which had one month of operations affected by the work stoppage at mills in the Northwest. Unit manufacturing costs were significantly lower and log costs were comparable. For oriented strand board, sales volumes were significantly higher due to increased production and improved transportation networks. Unit manufacturing costs and fiber costs were both moderately lower. Sales realizations and sales volumes were lower for most engineered wood products due to softening demand. Raw material costs were lower, primarily for oriented strand board webstock.

Q2 2023 Outlook – Weyerhaeuser anticipates second quarter earnings and Adjusted EBITDA will be slightly higher than the first quarter, excluding the effect of changes in average sales realizations for lumber and oriented strand board. For lumber, the company expects higher sales volumes and moderately lower log costs and unit manufacturing costs. For oriented strand board, the company anticipates comparable sales volumes, slightly lower fiber costs and moderately higher unit manufacturing costs. Sales volumes are expected to be significantly higher and raw material costs are expected to be moderately lower for most engineered wood products, partially offset by moderately lower sales realizations.

For the complete press release, click here.

About Weyerhaeuser

Weyerhaeuser Company, one of the world’s largest private owners of timberlands, began operations in 1900. We own or control approximately 11 million acres of timberlands in the U.S. and manage additional timberlands under long-term licenses in Canada. We manage these timberlands on a sustainable basis in compliance with internationally recognized forestry standards. We are also one of the largest manufacturers of wood products in North America. Our company is a real estate investment trust. In 2022, we generated $10.2 billion in net sales and employed approximately 9,200 people who serve customers worldwide. Our common stock trades on the New York Stock Exchange under the symbol WY. Learn more at www.weyerhaeuser.com.

Contact:

Nancy Thompson – Media Contact – Nancy.Thompson@wy.com – (919) 861-0342

Source: Weyerhaeuser Company