Weyerhaeuser Reports Second Quarter Results

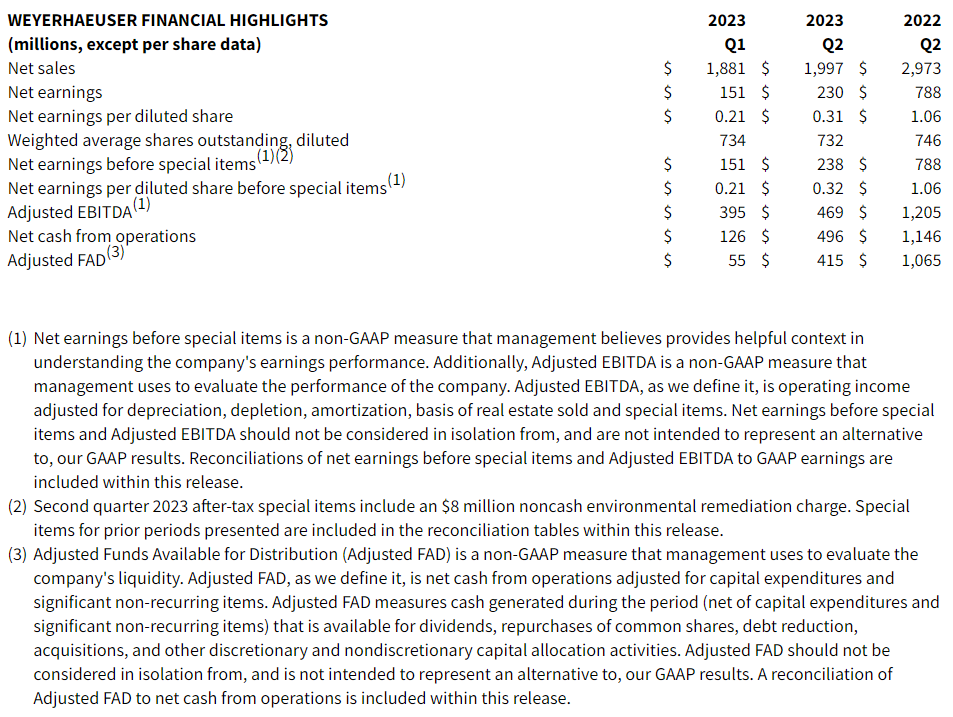

Weyerhaeuser Company (NYSE: WY) today reported second quarter net earnings of $230 million, or 31 cents per diluted share, on net sales of $2.0 billion. This compares with net earnings of $788 million, or $1.06 per diluted share, on net sales of $3.0 billion for the same period last year and net earnings of $151 million for first quarter 2023. Excluding an after-tax charge of $8 million for special items, the company reported second quarter net earnings of $238 million, or 32 cents per diluted share. There were no special items in second quarter 2022 or first quarter 2023. Adjusted EBITDA for second quarter 2023 was $469 million compared with $1.2 billion for the same period last year and $395 million for first quarter 2023.

Highlights:

- Achieved net earnings of $230 million, or $0.31 per diluted share, and net earnings before special items of $238 million, or $0.32 per diluted share

- Generated Adjusted EBITDA of $469 million, a 19 percent increase compared with first quarter 2023

- Completed strategic timberlands acquisition in Mississippi in July 2023

In July, Weyerhaeuser acquired 22 thousand acres of timberlands in Mississippi for approximately $60 million. These highly productive timberlands are strategically located to deliver immediate synergies with existing Weyerhaeuser operations and offer incremental real estate and natural climate solutions opportunities.

“In the second quarter, our teams delivered solid results across each of our businesses,” said Devin W. Stockfish, president and chief executive officer. “In addition, we continue to make meaningful progress towards our multi-year growth targets with the recent acquisition of high-quality timberlands in Mississippi. Looking forward, we are encouraged by recent improvements in the housing market, and maintain a favorable longer-term outlook for the demand fundamentals that will drive growth for our businesses. Our financial position is exceptionally strong, and we remain focused on delivering operational excellence across our unmatched portfolio of assets and enhancing shareholder value through disciplined capital allocation.”

Q2 2023 Performance – In the West, fee harvest volumes were slightly higher than the first quarter. Export sales realizations were lower, while domestic sales realizations were comparable. Sales volumes to China were significantly lower and domestic sales volumes were significantly higher as the company intentionally flexed logs to domestic customers to capture higher margin opportunities. Per unit log and haul costs were lower. In the South, fee harvest volumes were comparable, while sales realizations and per unit log and haul costs were slightly lower. Forestry and road costs in the West and South were seasonally higher.

Q3 2023 Outlook – Weyerhaeuser anticipates third quarter earnings and Adjusted EBITDA will be approximately $25 million lower than the second quarter. In the West, the company expects fee harvest volumes and sales realizations to be moderately lower, partially offset by improved per unit log and haul costs. In the South, sales realizations are expected to be slightly lower, while fee harvest volumes and per unit log and haul costs are expected to be comparable. The company expects forestry and road costs in the West and South to be seasonally higher.

Q2 2023 Performance – Earnings and Adjusted EBITDA decreased from the first quarter due to lower real estate sales. The number of acres sold decreased significantly due to the timing of transactions. The average price per acre was significantly higher and the average basis as a percentage of sales was significantly lower due to the mix of properties sold.

Q3 2023 Outlook – Weyerhaeuser anticipates third quarter earnings will be slightly higher than the second quarter and Adjusted EBITDA will be approximately $20 million higher than the second quarter due to the timing and mix of real estate sales. The company still expects full year 2023 Adjusted EBITDA of approximately $300 million and now expects basis as a percentage of real estate sales to be 35 to 40 percent for the full year.

Q2 2023 Performance – Sales realizations for lumber and oriented strand board increased 6 percent and 11 percent, respectively, compared with first quarter averages. Sales volumes for lumber were moderately higher and log costs were slightly lower, primarily for western logs. Unit manufacturing costs were slightly higher. For oriented strand board, sales and production volumes were moderately lower and unit manufacturing costs were moderately higher due to planned downtime for annual maintenance as well as a temporary period of unplanned downtime resulting from wildfire activity near the company’s facility in Alberta. Fiber costs were slightly lower. Sales and production volumes were significantly higher for most engineered wood products, driven by improving demand from the homebuilding segment. Unit manufacturing costs were significantly lower for solid section and I-joist products, and raw material costs were lower for all products. Sales realizations were lower for most engineered wood products. Distribution results were significantly higher due to strong sales volumes for engineered wood products.

Q3 2023 Outlook – Weyerhaeuser anticipates third quarter earnings and Adjusted EBITDA will be significantly higher than the second quarter due to higher average sales realizations for lumber and oriented strand board. Excluding the effect of those items, the company expects third quarter financial results will be slightly lower than the second quarter. For lumber, the company expects moderately higher sales volumes, moderately lower log costs and slightly lower unit manufacturing costs. For oriented strand board, the company anticipates comparable sales volumes and fiber costs and slightly higher unit manufacturing costs. For engineered wood products, the company expects slightly higher sales volumes, slightly lower sales realizations and higher raw material costs, primarily for oriented strand board webstock.

For the complete press release, click here.

About Weyerhaeuser

Weyerhaeuser Company, one of the world’s largest private owners of timberlands, began operations in 1900. We own or control approximately 11 million acres of timberlands in the U.S. and manage additional timberlands under long-term licenses in Canada. We manage these timberlands on a sustainable basis in compliance with internationally recognized forestry standards. We are also one of the largest manufacturers of wood products in North America. Our company is a real estate investment trust. In 2022, we generated $10.2 billion in net sales and employed approximately 9,200 people who serve customers worldwide. Our common stock trades on the New York Stock Exchange under the symbol WY. Learn more at www.weyerhaeuser.com.

Contact:

Nancy Thompson – Media Contact – Nancy.Thompson@wy.com – (919) 861-0342

Source: Weyerhaeuser Company