FHA Announces 2024 Loan Limits, Empowering Homebuyers Amidst Rising Home Prices

The Federal Housing Administration announces new loan limits on Title II forward and Home Equity Conversion Mortgages for 2024 for single-family homes

Today, the Federal Housing Administration (FHA) is announcing new loan limits for calendar year 2024 for its Single Family Title II forward and Home Equity Conversion Mortgage (HECM) insurance programs. Loan limits for most of the country will increase in the coming year due to continued strong home price appreciation over the past year.

“The statutory loan limit increases announced today reflect the continued rise in home prices seen throughout most of the nation in 2023,” said Assistant Secretary for Housing and Federal Housing Commissioner Julia Gordon. “The increases to FHA’s loan limits will enable homebuyers to use FHA’s low-down-payment financing to access homeownership at a time when a lack of affordability threatens to shut well qualified borrowers out of the market.”

FHA is required to update its annual loan limits each year using a formula prescribed in the National Housing Act. This formula uses county or Metropolitan Statistical Area (MSA) home sale data to derive new loan limits for the three different cost categories established by the law.

Forward Mortgage Loan Limits

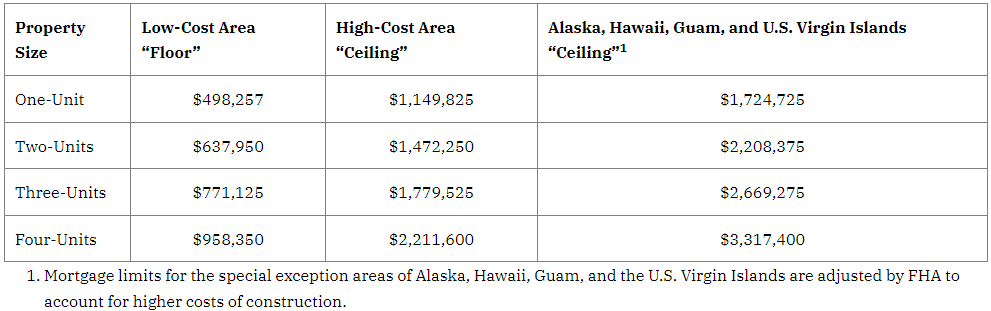

The new forward mortgage loan limits in the table below are effective for FHA case numbers assigned on or after January 1, 2024.

The maximum loan limits for FHA forward mortgages will rise in 3,138 counties. In 96 counties, FHA’s loan limits will remain unchanged.

HECM Loan Limits

The HECM maximum claim amount will increase from $1,089,300 in calendar year 2023 to $1,149,825 effective for FHA case numbers assigned on or after January 1, 2024. This maximum claim amount is applicable to all areas, including the special exception areas of Alaska, Hawaii, Guam, and the U.S. Virgin Islands.

Calculation of Loan Limits

FHA is required by the National Housing Act (NHA), as amended by the Housing and Economic Recovery Act of 2008 (HERA), to set Single Family forward mortgage loan limits at 115 percent of area median house prices for a particular jurisdiction, subject to a specified floor and a ceiling. In accordance with the NHA, FHA calculates forward mortgage limits by MSA and county.

The NHA requires FHA to establish its floor and ceiling loan limits based on the national conforming loan limit set by the Federal Housing Finance Agency (FHFA) for conventional mortgages owned or guaranteed by the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac).

The national conforming loan limit for 2024 for a one-unit property is $766,550. FHA’s 2024 minimum national loan limit floor of $498,257 for a one-unit property is set at 65 percent of the national conforming loan limit. This floor applies to those areas where 115 percent of the median home price is less than the floor limit. Any area where the loan limit exceeds this floor is considered a high-cost area. In these areas, FHA establishes varying loan limits above the floor based upon the respective median home prices in each area.

The NHA requires FHA to set its maximum loan limit ceiling for high-cost areas at $1,149,825, which is 150 percent of the national conforming loan limit. Forward mortgage limits for the special exception areas of Alaska, Hawaii, Guam, and the U.S. Virgin Islands are adjusted further by FHA to account for higher costs of construction.

Additionally, the FHA-insured HECM maximum claim amount is calculated at 150 percent of the Freddie Mac national conforming limit of $766,550. FHA’s current HECM regulations do not allow the HECM limit to vary by MSA or county; instead, the single HECM limit applies to all HECMs regardless of where the property is located.

To find a complete list of FHA loan limits, areas at the FHA ceiling, and areas between the floor and the ceiling, visit FHA’s Loan Limits Page.

###

HUD’s mission is to create strong, sustainable, inclusive communities and quality affordable homes for all.

More information about HUD and its programs is available at www.hud.gov and https://espanol.hud.gov.

You can also connect with HUD on social media and follow Secretary Fudge on Twitter and Facebook or sign up for news alerts on HUD’s Email List.

HUD COVID-19 Resources and Fact Sheets

Learn More About HUD’s Property Appraisal and Valuation Equity Work

Source: U.S. Department of Housing and Urban Development