Weyerhaeuser Reports Fourth Quarter and Full Year Results

- Generated full year net earnings of $839 million, or $1.15 per diluted share

- Achieved full year Adjusted EBITDA of $1.7 billion

- Returning $783 million in total cash back to shareholders based on 2023 results, including $125 million of share repurchase completed in 2023

- Monetized company’s first forest carbon credits

- Enhanced company’s Southern Timberlands portfolio with the completion of strategic transactions in the fourth quarter

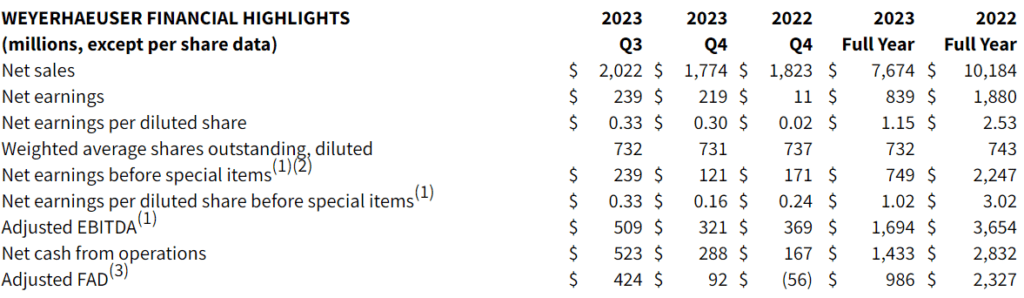

Weyerhaeuser Company reported fourth quarter net earnings of $219 million, or 30 cents per diluted share, on net sales of $1.8 billion. This compares with net earnings of $11 million, or 2 cents per diluted share, on net sales of $1.8 billion for the same period last year and net earnings of $239 million for third quarter 2023. Excluding a total after-tax benefit of $98 million for special items, the company reported fourth quarter net earnings of $121 million, or 16 cents per diluted share. This compares with net earnings before special items of $171 million for the same period last year. There were no special items in third quarter 2023. Adjusted EBITDA for fourth quarter 2023 was $321 million, compared with $369 million for the same period last year and $509 million for third quarter 2023.

For full year 2023, Weyerhaeuser reported net earnings of $839 million, or $1.15 per diluted share, on net sales of $7.7 billion. This compares with net earnings of $1.9 billion on net sales of $10.2 billion for full year 2022. Full year 2023 includes a total after-tax benefit of $90 million for special items. Excluding these items, the company reported net earnings of $749 million, or $1.02 per diluted share. This compares with net earnings before special items of $2.2 billion for full year 2022. Adjusted EBITDA for full year 2023 was $1.7 billion, compared with $3.7 billion for full year 2022.

In December, Weyerhaeuser completed previously announced transactions in its Southern Timberlands portfolio, including the acquisition of mature and highly productive acreage in the Carolinas and Mississippi that is well-integrated with the company’s existing operations, and the divestiture of less strategic acreage in South Carolina.

This afternoon, the company declared a $0.14 per share supplemental dividend. On a combined basis, including dividends and share repurchase, the company is returning $783 million of cash, or approximately 80 percent of 2023 Adjusted FAD, to shareholders based on 2023 results.

“Our performance in 2023 reflects solid execution across all businesses, notwithstanding challenging market conditions,” said Devin W. Stockfish, president and chief executive officer. “In addition, our teams drove meaningful improvements across each of the value levers of our investment thesis in 2023. Notably, we optimized our timberlands holdings through strategic transactions in the Carolinas and Mississippi, captured additional operational excellence improvements, grew our Natural Climate Solutions business and sold our first forest carbon credits in the voluntary market. We also increased our base dividend by 5.6 percent and repurchased $125 million of our shares. Entering 2024, we are encouraged by resiliency in the housing market and maintain a favorable longer-term outlook for the demand fundamentals that will drive growth for our businesses. Our balance sheet is exceptionally strong, and we remain focused on serving our customers and driving long-term value for shareholders through our unrivaled portfolio, industry-leading performance, strong ESG foundation and disciplined capital allocation.”

Timberlands

Q4 2023 Performance

In the West, fee harvest volumes were slightly lower than the third quarter. Domestic sales volumes were lower and export volumes were significantly higher as the company flexed volumes to China to capture higher margin opportunities. Sales realizations were moderately higher, primarily due to the increase in export sales volumes. Per unit log and haul costs were moderately higher and forestry and road costs were seasonably lower. In the South, fee harvest volumes, sales realizations, and per unit log and haul costs were all comparable to the third quarter. Forestry and road costs were seasonally lower.

Fourth quarter pretax special items include an $84 million gain on the previously announced sale of timberlands in South Carolina and a $25 million legal benefit.

Q1 2024 Outlook

Weyerhaeuser anticipates first quarter earnings before special items and Adjusted EBITDA will be comparable to the fourth quarter. In the West, the company expects moderately higher fee harvest volumes and significantly lower per unit log and haul costs. Sales realizations are expected to be slightly lower due to mix. In the South, the company expects moderately lower fee harvest volumes and comparable sales realizations and per unit log and haul costs. Forestry and road costs in the West and South are expected to be seasonally lower.

Real Estate, Energy & Natural Resources

Q4 2023 Performance

Earnings and Adjusted EBITDA decreased from the third quarter primarily due to lower real estate sales. The number of acres sold decreased significantly due to the timing of transactions. The average price per acre was higher and the average basis as a percentage of sales was lower due to the mix of properties sold.

Q1 2024 Outlook

Weyerhaeuser anticipates first quarter earnings will be comparable to the fourth quarter and Adjusted EBITDA will be approximately $15 million higher than the fourth quarter due to the timing and mix of real estate sales. The company anticipates full year 2024 Adjusted EBITDA for the segment will be approximately $320 million.

Wood Products

Q4 2023 Performance

Sales realizations for lumber and oriented strand board decreased 14 percent and 17 percent, respectively, compared with third quarter averages. Sales volumes for lumber were moderately lower and unit manufacturing costs were moderately higher due to a decrease in production levels, partially driven by holiday downtime taken at the company’s Pacific Northwest mills. Log costs were comparable. For oriented strand board, sales volumes and fiber costs were comparable, while unit manufacturing costs were moderately lower. Sales realizations were slightly lower for most engineered wood products, while raw material costs were slightly higher. Sales volumes were lower and unit manufacturing costs were slightly lower. Distribution results were lower due to a decrease in commodity realizations and seasonally lower sales volumes.

Fourth quarter pretax special items include a $14 million insurance recovery.

Q1 2024 Outlook

Weyerhaeuser anticipates first quarter earnings before special items and Adjusted EBITDA will be slightly higher than the fourth quarter, excluding the effect of changes in average sales realizations for lumber and oriented strand board. For lumber, the company expects higher sales volumes, slightly lower log costs, and moderately lower unit manufacturing costs. For oriented strand board, the company anticipates moderately higher sales volumes, slightly higher fiber costs and slightly lower unit manufacturing costs. For engineered wood products, the company expects moderately higher sales volumes, primarily for solid section products, slightly lower sales realizations for most products, and slightly lower raw material costs. For distribution, the company anticipates higher results compared to the fourth quarter.

To view the full press release, click here.

About Weyerhaeuser

Weyerhaeuser Company, one of the world’s largest private owners of timberlands, began operations in 1900. We own or control approximately 10.5 million acres of timberlands in the U.S. and manage additional timberlands under long-term licenses in Canada. We manage these timberlands on a sustainable basis in compliance with internationally recognized forestry standards. We are also one of the largest manufacturers of wood products in North America. Our company is a real estate investment trust. In 2023, we generated $7.7 billion in net sales and employed approximately 9,300 people who serve customers worldwide. Our common stock trades on the New York Stock Exchange under the symbol WY.

Learn more at www.weyerhaeuser.com.

Contact:

Nancy Thompson – Media Contact – nancy.thompson@wy.com – (919) 861-0342

Source: Weyerhaeuser Company