Freddie Mac: Mortgage Rates Tick Down

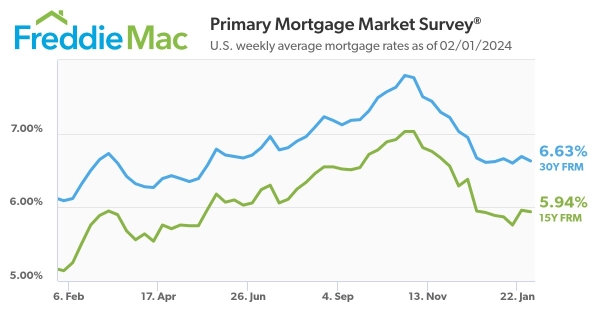

Freddie Mac released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.63 percent.

“Although affordability continues to impact homeownership, the combination of a solid economy, strong demographics and lower mortgage rates are setting the stage for a more robust housing market,” said Sam Khater, Freddie Mac’s Chief Economist.

Khater elaborated, “Mortgage rates have been stable for nearly two months, but with continued deceleration in inflation we expect rates to decline further. The economy continues to outperform due to solid job and income growth, while household formation is increasing at rates above pre-pandemic levels. These favorable factors should provide strong fundamental support to the market in the months ahead.”

News Facts

- The 30-year FRM averaged 6.63 percent as of February 1, 2024, down from last week when it averaged 6.69 percent. A year ago at this time, the 30-year FRM averaged 6.09 percent.

- The 15-year FRM averaged 5.94 percent, down from last week when it averaged 5.96 percent. A year ago at this time, the 15-year FRM averaged 5.14 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit. For more information, view our Frequently Asked Questions.

About Freddie Mac

Freddie Mac’s mission is to make home possible for families across the nation. We promote liquidity, stability, affordability and equity in the housing market throughout all economic cycles. Since 1970, we have helped tens of millions of families buy, rent or keep their home. Learn More: Website | Consumers | Twitter | LinkedIn | Facebook | Instagram | YouTube

Contact:

Angela Waugaman – Angela_Waugaman@FreddieMac.com – (703) 714-0644

Source: Freddie Mac