CoreLogic: US Mortgage Performance Ends 2023 on a Largely Stable Note

The national overall mortgage delinquency rate was 3.1% in December, generally in line with numbers recorded since the spring of 2022

Seventeen states posted annual overall mortgage delinquency increases, led by Louisiana (up by 0.4 percentage points) and Hawaii (up by 0.3 percentage points)

The U.S. foreclosure rate remained at 0.3% for the 22nd consecutive month

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its monthly Loan Performance Insights Report for December 2023.

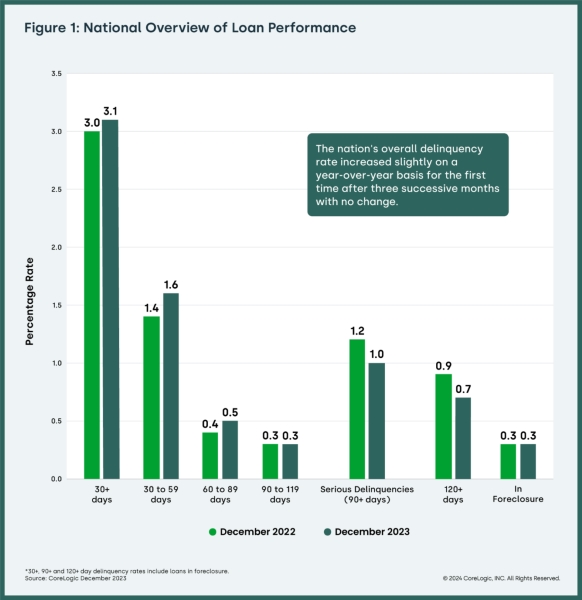

In December 2023, 3.1% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), up by 0.1 percentage points year-over-year from December 2022 and up by 0.2 percentage points month-over-month from November 2023.

To gain a complete view of the mortgage market and loan performance health, CoreLogic examines all stages of delinquency. In December 2023, the U.S. delinquency and transition rates and their year-over-year changes, were as follows:

- Early-Stage Delinquencies (30 to 59 days past due): 1.6%, up from 1.4% in December 2022.

- Adverse Delinquency (60 to 89 days past due): 0.5%, up from 0.4% in December 2022.

- Serious Delinquency (90 days or more past due, including loans in foreclosure): 1%, down from 1.2% in December 2022 and a high of 4.3% in August 2020.

- Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, unchanged from December 2022.

- Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.9%, up from December 2022.

Although the overall U.S. mortgage delinquency rate ticked up slightly in December from the previous few months, it remained low by historical standards. Similarly, 17 states posted annual overall delinquency rate increases, but these gains were all less than one-half of a percentage point. Despite continued healthy mortgage performance, other expenses could squeeze some homeowners’ budgets in the coming months.

“Early-stage mortgage delinquency rates increased in December 2023 from one year earlier but remained near historic lows.” said Molly Boesel, principal economist for CoreLogic. “There were offsetting declines of home loans that were six months or more past due, which led to a drop in the serious delinquency rate.”

“However, other types of consumer credit showed increases in serious delinquency rates at the end of 2023,” Boesel continued. “The Federal Reserve reports that the number of credit-card and automobile-loan transitions moving into serious delinquency were above pre-pandemic levels, which could be a signal of increased financial stress for some Americans.”

State and Metro Takeaways:

- Seventeen states saw overall mortgage delinquency rates increase year over year in December. The states with the largest gains were Louisiana (up by 0.4 percentage points) and Hawaii (up by 0.3 percentage points). Fifteen states showed no change in overall delinquency rates year over year. The remaining states’ annual delinquency rates declined between -0.4 percentage points and -0.1 percentage points.

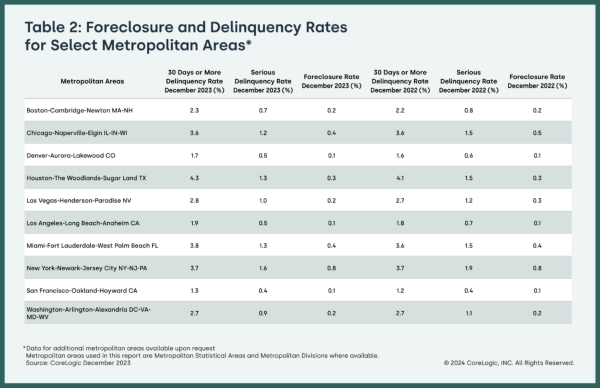

- In December, 159 U.S. metro areas posted increases in overall year-over-year delinquency rates. The metro with the largest delinquency rate increase was Kahului-Wailuku-Lahainia, Hawaii (up by 2.5 percentage points), followed by New Orleans-Metairie, Louisiana (up by 0.7 percentage points).

- In December, three U.S. metro areas posted an annual increase in serious delinquency rates (defined as 90 days or more late on a mortgage payment), while 31 metros recorded no change. Declines in other metros ranged from -1.6 percentage points to -0.1 percentage points. The metros that posted annual serious delinquency increases were Kahului-Wailuku-Lahainia, Hawaii (up by 2.2 percentage points); and Carson City, Nevada and Valdosta, Georgia (both up by 0.1 percentage points).

The next CoreLogic Loan Performance Insights Report will be released on March 28, 2024, featuring data for January 2024. For ongoing housing trends and data, visit the CoreLogic Intelligence Blog: www.corelogic.com/intelligence.

Methodology

The data in The CoreLogic LPI report represents foreclosure and delinquency activity reported through December 2023. The data in this report accounts for only first liens against a property and does not include secondary liens. The delinquency, transition and foreclosure rates are measured only against homes that have an outstanding mortgage. Homes without mortgage liens are not subject to foreclosure and are, therefore, excluded from the analysis. CoreLogic has approximately 75% coverage of U.S. foreclosure data.

Source: CoreLogic

The data provided is for use only by the primary recipient or the primary recipient’s publication or broadcast. This data may not be re-sold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact Robin Wachner at newsmedia@corelogic.com. For sales inquiries, please visit https://www.corelogic.com/support/sales-contact/. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

To view the original release, click here.

About CoreLogic

CoreLogic is a leading provider of property insights and innovative solutions, working to transform the property industry by putting people first. Using its network, scale, connectivity and technology, CoreLogic delivers faster, smarter, more human-centered experiences that build better relationships, strengthen businesses and ultimately create a more resilient society. For more information, please visit www.corelogic.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries.

Contact:

Robin Wachner – Media Contact – newsmedia@corelogic.com

Source: CoreLogic, Inc.