Atlas Engineered Products Reports First Quarter 2025 Financial and Operating Results

Atlas Engineered Products (“AEP” or the “Company”) is pleased to announce its financial and operating results for the three months ended March 31, 2025. All amounts are presented in Canadian dollars.

Financial and Operating Highlights

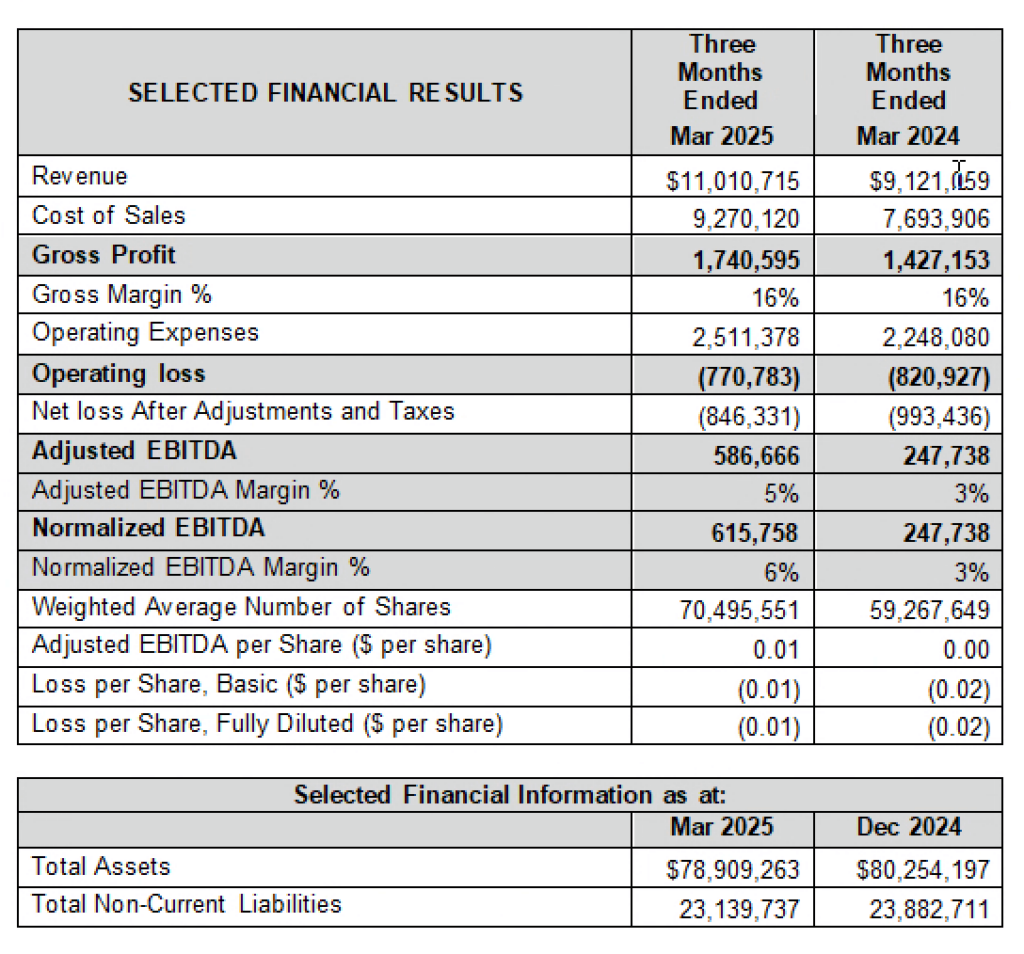

- Revenue of $11M, representing an increase of 21% year-over-year

- Wall Panel revenue increased by 42% year-over-year

- Engineered Wood Products revenue increased by 30% year-over-year

- Adjusted EBITDA of $586,666, representing an increase of 137% year-over-year

Hadi Abassi, President and CEO of AEP, commented: “I continue to be proud and impressed with the effort and results that the team at AEP have accomplished. Despite the housing start statistics and convoluted political and economic climates, the Company delivered a 21% increase in revenue over last year and worked diligently to drive organic growth in wall panels and engineered wood products, in addition to increasing production on roof trusses. I am encouraged by the start of 2025 to continue our organic growth initiatives across Canada and strategic acquisitions that will further strengthen our geographical footprint.”

Revenue for the three months ended March 31, 2025 was $11,010,715 compared to revenue of $9,121,059 for the three months ended March 31, 2024. Revenue has increased due to significant progress on the integration of LCF. LCF increased revenues by 56% compared to the prior year through organic growth by expanding into the wood frame commercial building market. Additionally, the Company has seen a 30% increase in engineered wood product sales for the three months ended March 31, 2025 compared to the three months ended March 31, 2024. The Company has been able to expand its supply of engineered wood products to the multi-family building sector due to the expansion of our salesforce, skill of our design team, and buying power with our national supplier.

Gross margin remained consistent at 16% for the three months ended March 31, 2025 compared to the three months ended March 31, 2024. The Company generally sees lower margins during the first fiscal quarter when the seasonality of the construction industry is the worst. The Company needs to maintain key skilled labour even though revenues are typically lower than during the rest of the year. Additionally, the quieter first quarter is the best time to perform maintenance and repairs on all vehicles and manufacturing equipment to ensure the best efficiency and reduce downtime during the busier construction season in summer and fall.

Net loss after taxes was $846,331 for the three months ended March 31, 2025 compared to net loss after taxes of $993,436 for the three months ended March 31, 2024. Net loss after taxes has reduced compared to the prior period due to the increase in revenues. The change was offset a bit by non-cash items such as depreciation and amortization and share-based payments which resulted in an increase in operating expenses. These amounts are added back for adjusted and normalized EBITDA.

Non-IFRS measure adjusted EBITDA for the three months ended March 31, 2025 was $586,666 with an adjusted EBITDA margin of 5%. Adjusted EBITDA for the three months ended March 31, 2024 was $247,738 with an adjusted EBITDA margin of 3%. These increases were mainly due to increased sales. While net loss for the period did not increase at the same rate, this was due to non-cash items of depreciation and amortization and share-based payments, which are added back for adjusted EBITDA.

Selected Financial Results

Outlook for 2025

The Company is continuing to see strong quoting volumes in comparison to 2024, previously reporting a 25% increase in quoting volume year over year. With an additional month completed, the Company sees this trend continuing as the first four months of 2025 resulted in a 29% increase in quoting volume compared to the first four months of 2024. Orders have remained stagnant with small increases for the first four months. However, since the federal election in Canada has concluded, the Company has seen significantly more orders being placed and looks forward to this trend continuing with further political and economic stability, along with strong government support of the construction industry.

AEP continues to work at delivering organic growth through increased wall panel manufacturing and supply of engineered wood products. This organic growth will continue to help insulate the Company to potential effects of a recession by allowing for increased sales volume potential per order. While industry volumes are largely driven by macroeconomic and political factors beyond the Company’s control, AEP will leverage its scale, agility and strong balance sheet to further gain market share.

The Company plans to build capacity during the busy construction season by adding automation and completing projects ahead in the winter months. As of March 31, 2025, finished goods and inventories have increased compared to December 31, 2024, due to this strategy. Projects built in the first quarter will be shipped in the second and third quarters when locations are at full capacity.

AEP believes that the future of the industry will be in significantly automated manufacturing facilities that can produce higher volumes at a lower cost. The new automation facility in Ontario is continuing with the completion of the steel framing and commencement of cladding for the facility. The building is still anticipated to be completed later in 2025.

In addition to the Company’s organic growth strategies, the Company is evaluating acquisition opportunities across North America. In September, the Company announced due diligence completion for a future acquisition in Western Canada which was anticipated to close in early Spring of 2025. This closing is still anticipated for Spring of 2025.

About Atlas Engineered Products Ltd.

AEP is a growth company that is acquiring and operating profitable, well-established operations in Canada’s truss and engineered products industry. We have a well-defined and disciplined acquisition and operating growth strategy enabling us to scale aggressively and apply new technologies, giving us a unique opportunity to consolidate a fragmented industry of independent operators.

Contact:

Jake Bouma – Representative for AEP – (604) 317-3936 – jake.bouma@atlasaep.ca

Source: Atlas Engineered Products Ltd.