Freddie Mac: Mortgage Rates Tick Up

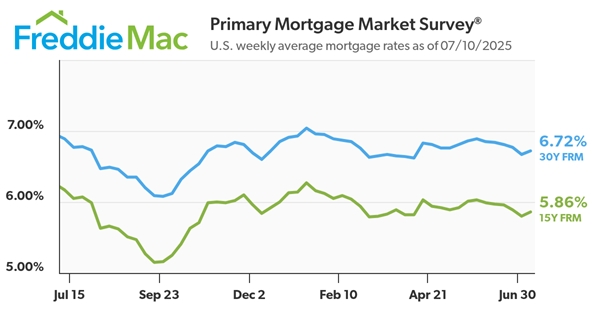

Freddie Mac released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.72%.

“After declining for five consecutive weeks, the 30-year fixed-rate mortgage moved slightly higher following a stronger than expected jobs report,” said Sam Khater, Freddie Mac’s Chief Economist. “Despite ongoing affordability challenges in the housing market, we are seeing home purchase and refinance applications respond to the downward trajectory in rates, increasing by 25% and 56%, respectively, compared to the same time last year.”

News Facts

- The 30-year FRM averaged 6.72% as of July 10, 2025, up from last week when it averaged 6.67%. A year ago at this time, the 30-year FRM averaged 6.89%.

- The 15-year FRM averaged 5.86%, up from last week when it averaged 5.80%. A year ago at this time, the 15-year FRM averaged 6.17%.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit. For more information, view our Frequently Asked Questions.

About Freddie Mac

Freddie Mac’s mission is to make home possible for families across the nation. We promote liquidity, stability and affordability in the housing market throughout all economic cycles. Since 1970, we have helped tens of millions of families buy, rent or keep their home. Learn More: Website | Consumers | X | LinkedIn | Facebook | Instagram | YouTube

Contact:

Angela Waugaman – Media Contact – angela_waugaman@freddiemac.com – (703) 714-0644

Source: Freddie Mac